Over the past week, bitcoin has exhibited a downward trend, with its price stabilizing at around $62,950 to $63,125 per unit as of April 27. Despite this dip, the Crypto Fear and Greed Index remains firmly in the “greed” sector. According to Google Trends, interest in the term “bitcoin” has diminished, while the market intelligence firm Santiment reports an uptick in BTC sell signals.

Bitcoin Remains Above $60K for 58 Days Despite Slipping Interest and Bearish Signals

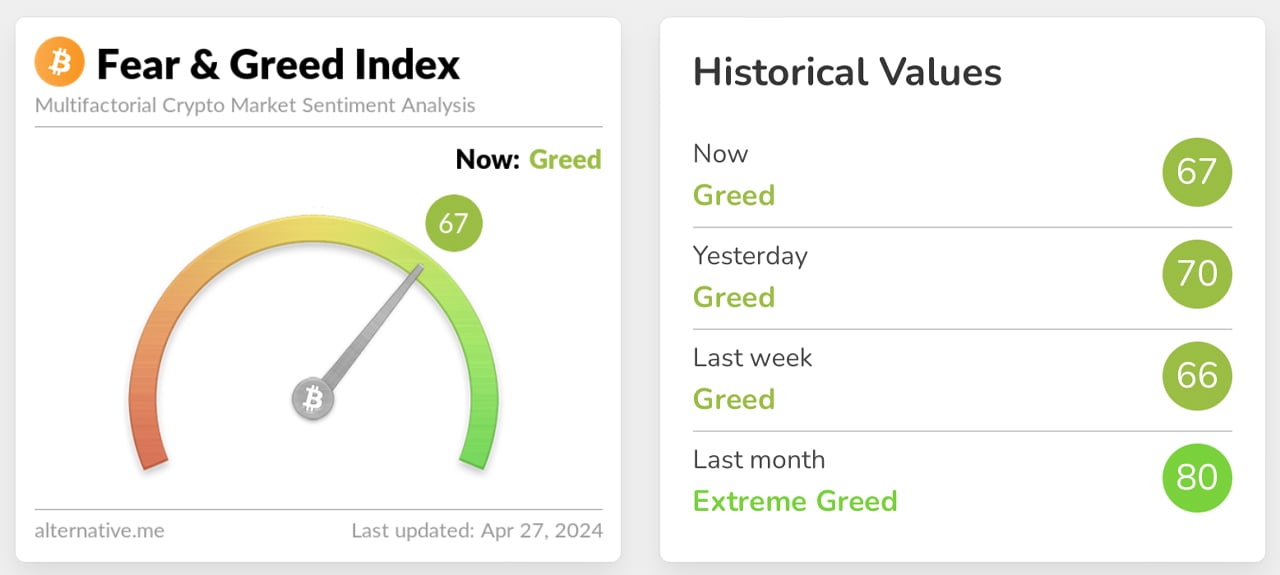

This weekend, bitcoin (BTC) remains confined within a specific range. BTC/USD charts indicate a “neutral” status across most oscillators, and the majority of moving averages suggest a continuation of the bearish outlook. On Saturday, the Crypto Fear and Greed Index (CFGI) hosted on alternative.me revealed that the sentiment of “greed” is still prevalent with a score of 69. Typically, a greedy sentiment in the CFGI suggests that the market could undergo a correction.

BTC has also experienced its longest period in 2024 with bitcoin’s value remaining over $60,000, lasting approximately 58 days. Post-halving, however, interest in bitcoin appears to be waning, as evidenced by Google Trends data, which shows a decline in searches for “bitcoin” from a high of 80 out of 100 on April 19 to a current score of 30.

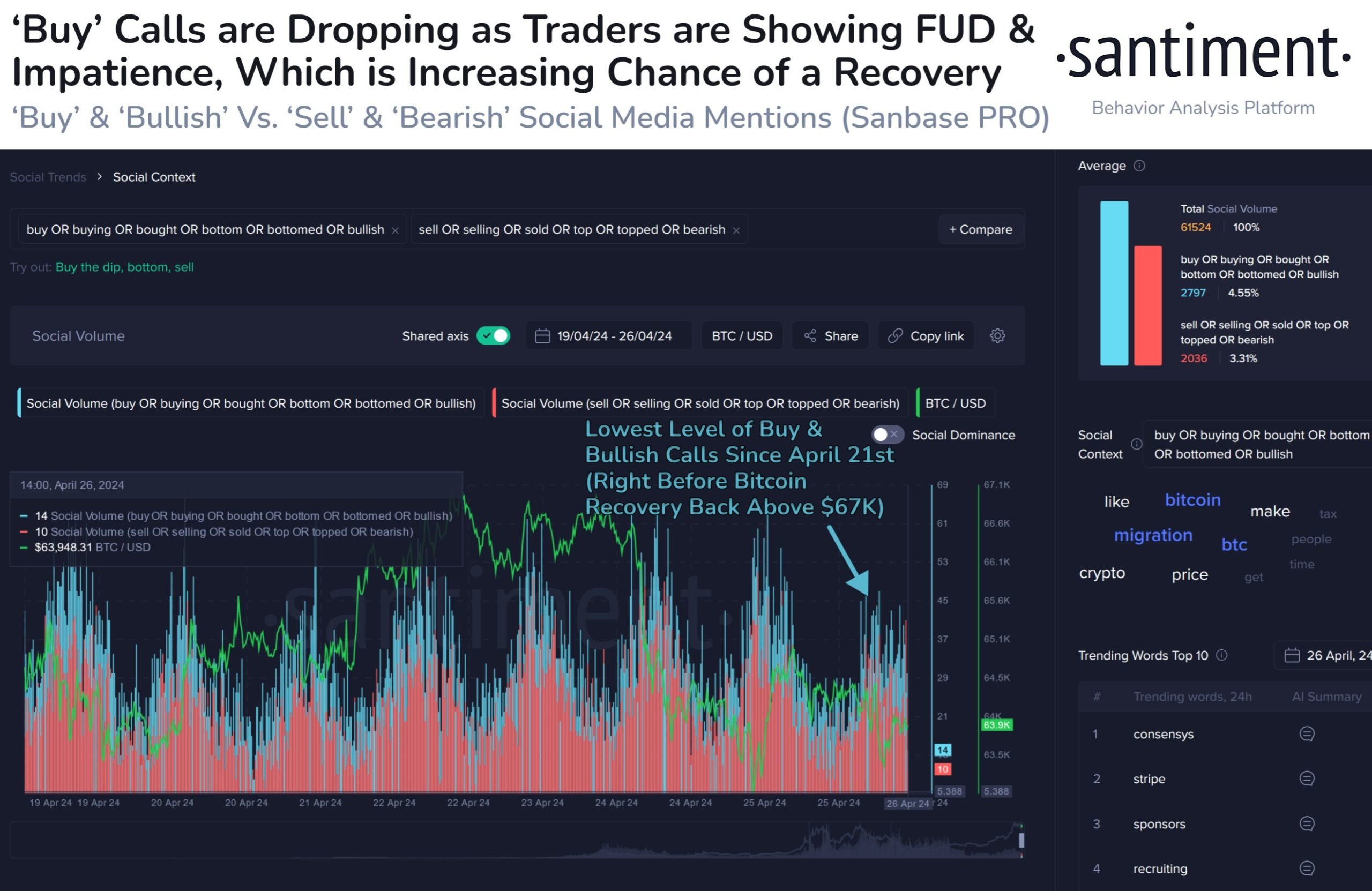

The downturn in interest began around April 21, based on 90-day statistics from Google Trends. Yet, related searches continue to probe for an unprecedented price high, with queries like “bitcoin all-time high” and “ATH bitcoin” appearing frequently in GT’s related queries list. On Friday, the market intelligence firm Santiment reported a noticeable increase in “sell calls” on social media, indicating a heightened push for selling BTC.

“Bitcoin’s price dropping as low as $63.4K has crypto traders spooked, as buy calls across social media are low and sell calls are peeking in at an increased rate,” Santiment posted on platform X. “When this level of FUD begins to sneak in, market recovery probabilities increase,” concluded Santiment’s market analysts.

On the other hand, QCP Capital’s weekend brief notes that interest could pick up when Hong Kong’s spot bitcoin and ethereum exchange-traded funds (ETFs) launch next week. “There is a potentially positive catalyst next week as the [Hong Kong bitcoin and ethereum] spot ETFs begin trading,” QCP Capital said. “Interest is growing in what could be a gateway for the inflow of Asian institutional capital.”