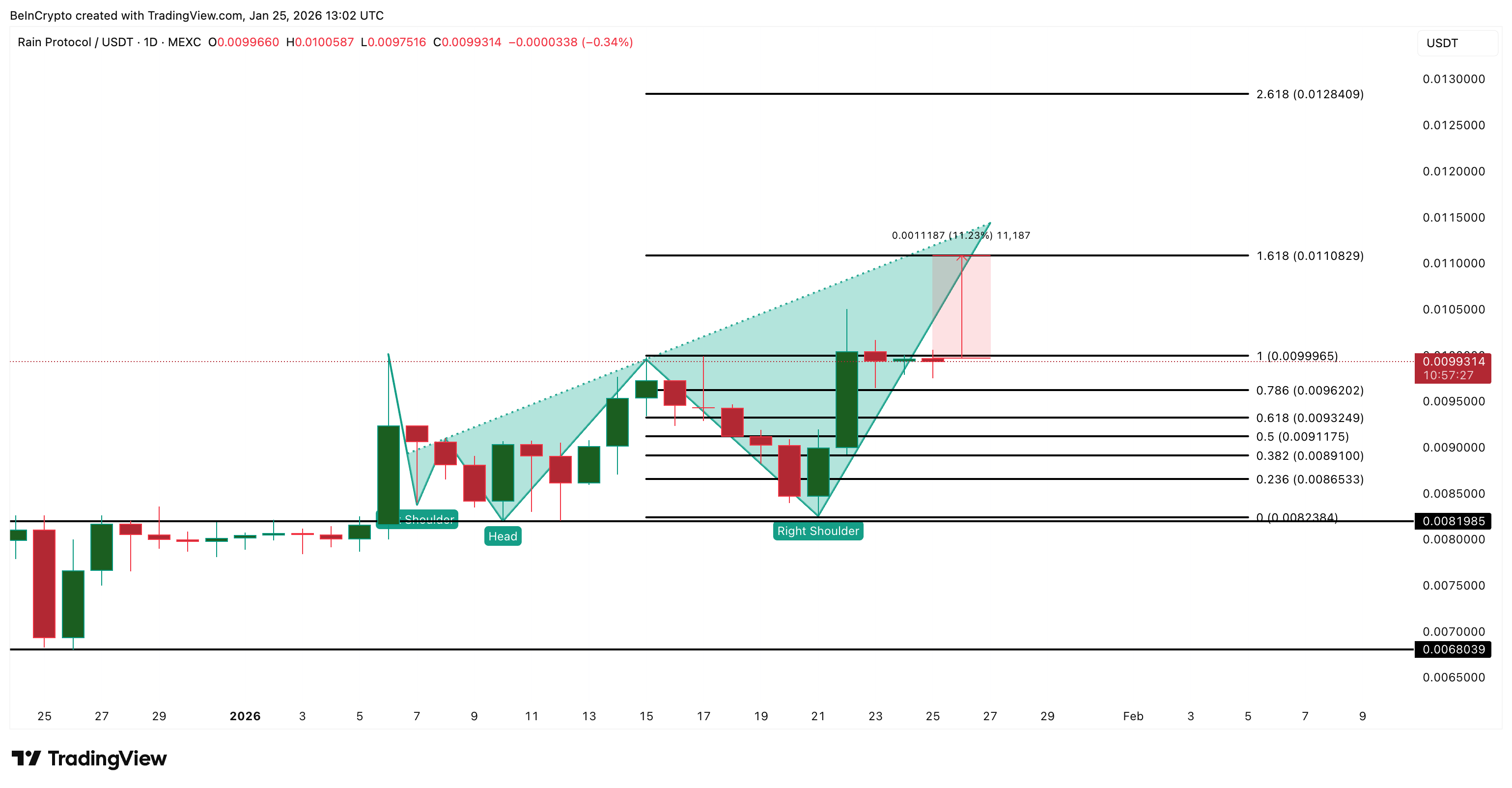

RAIN price has rallied nearly 40% over the past 30 days, keeping its breakout structure intact. The price is now trading just below $0.0104, but that level is no longer the real focus.

The active breakout structure points to a new projected all-time high above $0.0110, more than 10% higher from current levels. While upside remains open, fading momentum suggests sellers could return right where optimism peaks.

New All-Time High Is the Real Target, and Sellers Are Still Waiting

The active breakout inverse head-and-shoulders structure projects a new all-time high more than 10% above current prices, near the $0.0110 zone. That projected level, not the prior peak, is where traders are positioning. The current consolidation is not about profit-taking at old highs. It is about whether RAIN can expand into its next leg.

RAIN Breakout Structure">

RAIN Breakout Structure"> Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain behavior supports this view. Spent coins age band activity, which tracks how many tokens of all holding ages are being moved on-chain and often reflects selling or profit-taking, has collapsed over the past few days. Since January 22, spent coins activity has fallen from roughly 104.8 million to 25.4 million, a decline of nearly 76% in just three days.

That sharp drop means holders are not moving tokens despite rising prices, showing positive short-term behavior. This signals restraint, not distribution. Participants appear to be waiting for the projected all-time high attempt before acting. In simple terms, sellers have stepped aside for now, allowing the breakout path toward $0.0110 to remain intact. But this quiet phase is exactly where risks start to build.

Why Sellers Could Return Near the Projected ATH

The first warning comes from the structure forming beneath the original breakout.

As RAIN has continued higher since early January, a secondary inverse head-and-shoulders pattern has started to form. Unlike the earlier breakout structure, this one has a steeply up-sloping neckline and a right shoulder that is larger than the head. That shape makes follow-through harder. The projected upside from this structure is modest, roughly 13–14%, and it requires strong momentum to succeed.

Long-term momentum is not confirming that strength.

Between January 6 and January 22, RAIN’s price printed a higher high, while the Relative Strength Index (RSI) formed a lower high. RSI measures price momentum by comparing recent gains to losses. When price rises, but RSI weakens, it signals fading buying pressure, not strength. This bearish RSI divergence is appearing before the projected ATH is reached, which is a key warning.

The Money Flow Index (MFI) reinforces this concern. MFI tracks buying and selling pressure using both price and volume. Between January 6 and January 24, RAIN’s price moved sideways to slightly higher, but MFI trended lower. That shows dip buying is weakening, even though sellers are still inactive.

This explains the contradiction on the surface. Spent coins are falling because sellers are waiting. RSI and MFI are weakening because buyers are not stepping in aggressively.

Rallies supported by seller restraint rather than buyer expansion are fragile. If and when the RAIN price finally reaches the projected ATH zone, even moderate profit-taking (sellers returning) can tip the balance.

RAIN Price Levels That Matter Next

RAIN can still reach a new all-time high. Nothing in the data blocks that path outright.

A daily close above $0.0110 would confirm expansion beyond the breakout projection and open room toward $0.0128, driven largely by sentiment and momentum continuation.

However, risk builds quickly if the market hesitates near that zone.

If sellers return and spent coins activity spikes near the projected ATH, the first level to watch is $0.0099, where the recent structure begins to weaken. Below that, confidence in the setup fades.

RAIN Price Analysis">

RAIN Price Analysis"> A breakdown below $0.0082–$0.0081 would invalidate the newer right-shoulder and head structure and open the door toward $0.0068, marking a deeper corrective phase.