Even though the price has not fully confirmed it yet, Shiba Inu's most recent on-chain snapshot is conveying a message that is simple to overlook if you just look at the chart: exchange-related activity is changing, and it is changing in a way that frequently precedes a tradable recovery. The exchange outflow acceleration indicator is the loudest.

Shiba Inu gains strengh

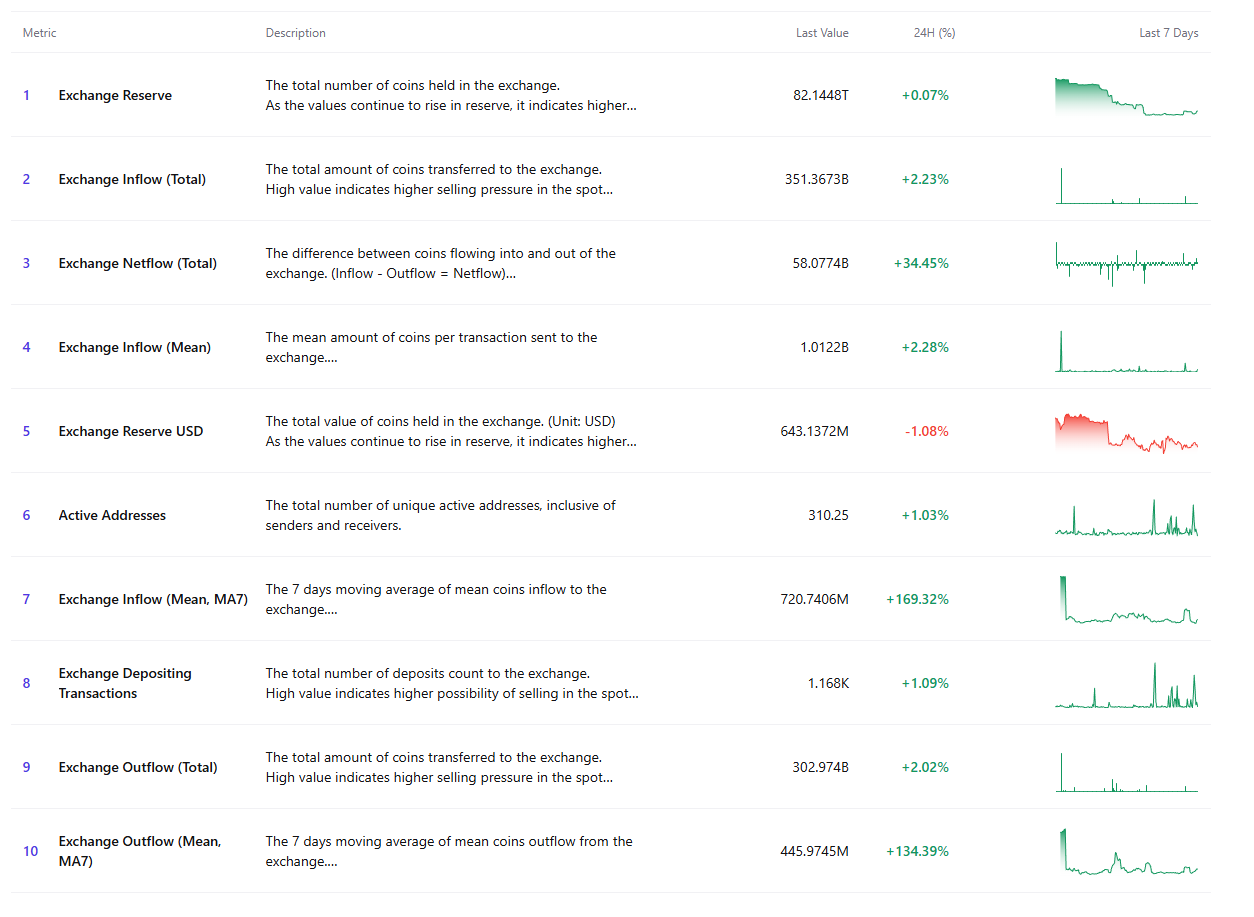

The mean exchange outflow over the last seven days has increased by +134%, and the total exchange outflow has also increased (302 billion, +2.02%). Simply put, more SHIB is leaving exchanges, which typically corresponds with less immediate sell availability and more hold positioning. When you combine that with an increase in active addresses (310. 25, +1.03%), you have a market that continues to participate rather than give up. However, the inflow side is still alive.

Netflow (inflow minus outflow) increased to 58.0774 billion (+34.4%), while total exchange inflow increased to 351 billion (+2.23%). The fact that some participants are obviously also sending tokens to exchanges, which may indicate distribution attempts or hedging, is what prevents this from being a clear-cut one-way bullish signal.

Reserves plummeting

However, context is important, and flows may be more important than headlines. The metrics you usually want to lead are outflows and their moving averages, which are rising quickly. Another encouraging fact is that while the coin-denominated reserve is essentially flat, the exchange reserve in USD is marginally down.

That combination can occur when positioning subtly improves while price is still suppressed. Zoom out to see the chart: SHIB is still in a wider downtrend and is still under strong moving-average resistance, but it is trying to establish a base with a support line that is slightly tilting upward.

The on-chain coins leaving exchanges may eventually result in price strength if the price can maintain this range and begin to reclaim the faster averages. In summary, the market is not overjoyed, but the plumbing appears more appealing than the candles. SHIB has a genuine chance at a recovery leg if these outflow-heavy conditions continue — as long as buyers provide follow-through rather than brief spiky capital injections.