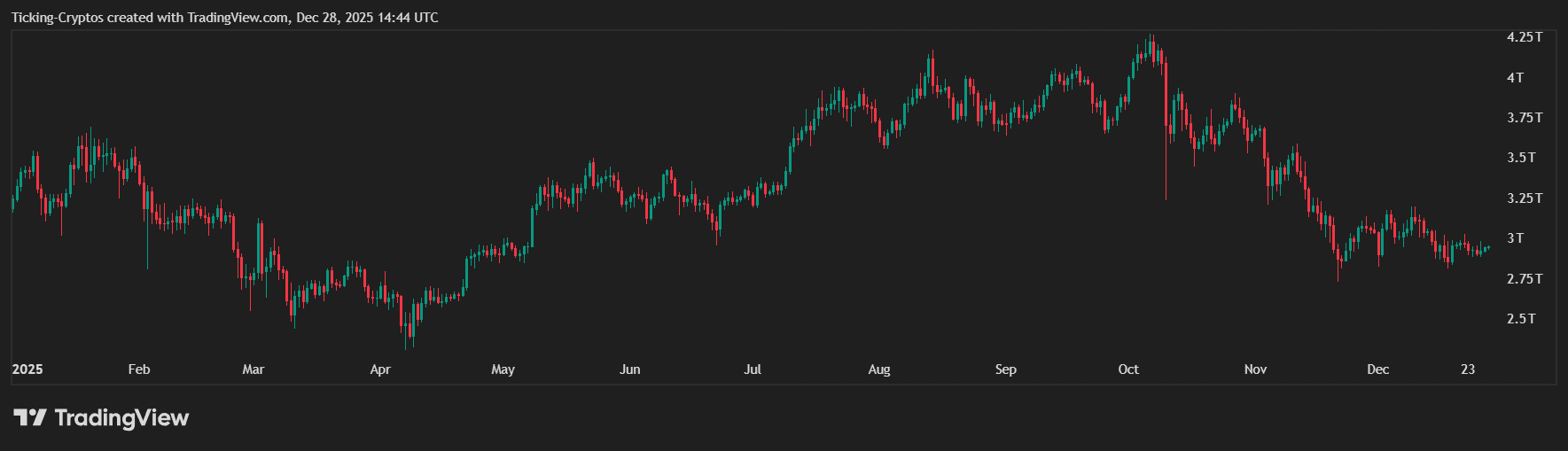

2025 delivered one of the most confusing market environments in recent history. Traditional assets surged, liquidity flooded the system, and yet crypto underperformed. $Silver posted triple-digit gains. Meanwhile: Even more puzzling, this divergence happened despite massive global liquidity injections from central banks and governments. That contradiction is at the heart of today’s crypto debate. Throughout 2025, global liquidity expanded rapidly: Historically, this type of environment has been extremely bullish for crypto. But this time, crypto failed to respond. Instead of acting as a liquidity sponge, Bitcoin and Ethereum lagged behind traditional assets — raising serious questions about what changed. After years of volatility, many large investors favored: Crypto, still perceived as higher risk and politically sensitive, was often the last allocation, not the first. Unlike gold or stocks, crypto faced internal pressures: Total crypto market cap in USD in 2025 - TradingView Liquidity entered the system — but not all liquidity flows into crypto equally. Despite progress, crypto in 2025 remained under: This discouraged short-term allocation even in an otherwise bullish macro environment. As 2025 closes, the market is left with two realistic scenarios. In this scenario: This would imply a slower, more utility-driven future with muted cycles — and much lower speculative upside. The alternative view is simpler: Crypto is late, not broken. Historically: If this pattern holds, 2025 could be remembered as the setup year, not the failure. If crypto catches up in 2026, the ingredients are already there: In that case, 2026 could see: If not, the market shifts permanently toward lower volatility and slower growth — a very different crypto era.Market Overview: A Strange Year for Risk Assets

$Gold surged aggressively.

The Nasdaq climbed strongly.

The Liquidity Paradox of 2025

Why Crypto Underperformed While Everything Else Rose

1️⃣ Capital Flow Shift Toward “Safer” Assets

2️⃣ Structural Selling Pressure in Crypto

3️⃣ Regulatory and Political Overhang

The Two Scenarios Heading Into 2026

Scenario 1: Something Structural Broke in Crypto

Scenario 2: Crypto Is Lagging — Not Failing

Crypto Price Prediction 2026: Catch-Up or Capitulation?

Why Crypto Underperformed in 2025, and What It Could Mean for 2026