An entity has leveraged a TWAP strategy to amass nearly $7 million worth of XRP across thousands of buy orders on Coinbase.

Market analyst and order book expert Dom first called attention to this interesting market behavior in a recent post on X. Notably, XRP purchases worth millions typically dominate exchanges on occasion, triggering no suspicions, but the recent buy orders caught the attention of market observers due to the manner of execution.

Entity Purchases Nearly $7M in XRP Using TWAP

Specifically, Dom confirmed that a trader had turned on some sort of Time-Weighted Average Price (TWAP) trading algorithm for XRP on Coinbase. He highlighted the XRP incident shortly after calling attention to an early TWAP that accumulated 30,000 Ethereum (ETH) over an hour on Binance.

Importantly, the goal is to get an average price close to the market’s typical price during that time. This approach helps traders, especially institutions, buy or sell steadily without causing sudden price swings.

Impact of the TWAP Order

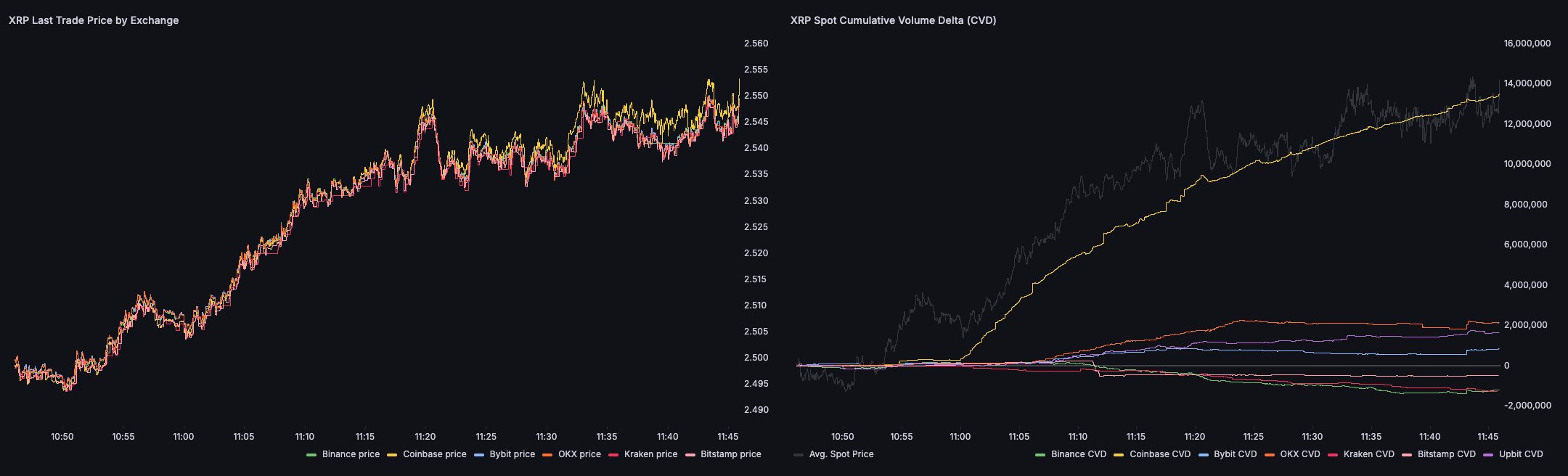

Data from an accompanying chart shared by Dom shows that the $6.8 million purchase spread across 4,287 buy orders had a massive impact on the XRP Cumulative Volume Delta (CVD) on Coinbase. Notably, the CVD measures the difference between the cumulative buy and sell orders on an exchange.

The large purchase led to a rapid spike on the Coinbase CVD from 11 AM on Oct. 31 to 11:45 AM, pushing the metric close to 14 million XRP. Interestingly, the CVDs of other crypto exchanges, including Binance, Bybit, OKX, Upbit, and Kraken, remained between -2 million and 2 million XRP within this period.

This development also had an observable impact on the XRP price on Coinbase. Specifically, while XRP traded around $2.545 on other exchanges, it rose to $2.555 on Coinbase, pushing the Coinbase Premium up.

Notably, this aligns with a recent commentary from Vincent Van Code, who suggested last month that, with the XRP reserve available on Binance order books, a single $15 million buy order could push prices to $15. The latest TWAP order, worth nearly $7 million, aimed to avoid such large price swings, as noted by Dom.