Shiba Inu ecosystem team, through its marketing lead Lucie, has unveiled a significant milestone for its primary token, SHIB.

In an X post titled, “Good News for SHIB Holders,” marketing lead Lucie celebrated Shiba Inu’s inclusion in the FTSE Grayscale Crypto Sectors Framework, a classification system jointly developed by Grayscale Investments and FTSE Russell.

Notably, Shiba Inu was listed under the Consumer & Culture” crypto sector. According to Lucie, this classification highlights Shiba Inu among the crypto projects contributing to community, culture, and entertainment within the digital asset space.

Notably, Grayscale has now listed Shiba Inu under the Consumer & Culture sector in its latest report. According to Lucie, the inclusion of Shiba Inu in the framework reaffirms that the project’s foundation is strong, its vision remains alive, and its future is undeniably real.

Shiba Inu Eligible for a Spot ETF

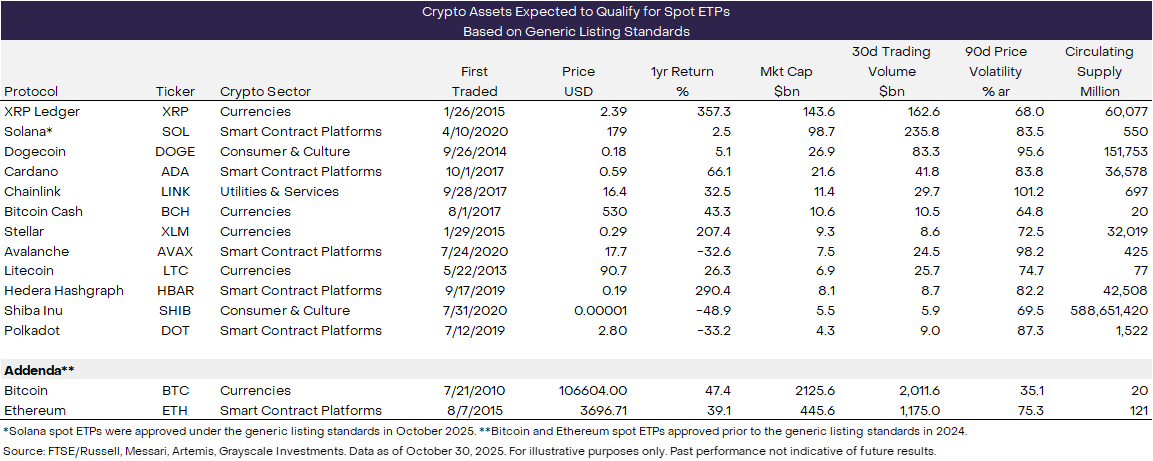

Meanwhile, the Grayscale report showcases crypto assets that meet the SEC’s Generic Listing Standards (GLS) framework, positioning them as potential candidates for spot ETPs.

According to the report, the GLS framework, approved in September, enables exchanges to list and trade crypto ETPs without seeking individual approval for each token. Under this framework, tokens could be approved for an ETF as long as they satisfy a specific set of generic criteria, alongside an effective registration statement.

Notably, at least 11 cryptocurrencies across four sectors qualify for spot ETPs under the SEC’s approved Generic Listing Standards (GLS) framework. In the Consumer & Culture sector, Shiba Inu and Dogecoin are the only assets recognized.

From the FTSE Grayscale Currencies sector, XRP, Litecoin, Stellar, and Bitcoin Cash meet the GLS requirements for spot ETFs, according to Grayscale.

Within the Smart Contract Platforms niche, Polkadot, Cardano, Solana, and Avalanche qualify as eligible tokens. Lastly, Chainlink stands as the sole representative from the Utilities & Services sector that qualifies for a spot ETP.

In the meantime, Solana and Litecoin ETFs are currently trading in the U.S., with other cryptocurrencies, such as Cardano, XRP, Dogecoin, and Bitcoin Cash, awaiting approval.

No Standalone SHIB ETF Application in the US

Despite the push to have Grayscale launch a spot ETF tied to SHIB, Shiba Inu still does not have an exclusive spot ETF application in the U.S. However, leading asset manager T. Rowe Price recently highlighted Shiba Inu among the cryptos that could feature in its Active Crypto ETF.

Beyond the U.S., Valour Inc. launched a SEK-denominated ETP linked to Shiba Inu’s price action in Europe. Although Grayscale highlights Shiba Inu among the tokens eligible for a spot ETP under the GLS framework, it remains uncertain whether the asset manager would follow through with a registration statement.