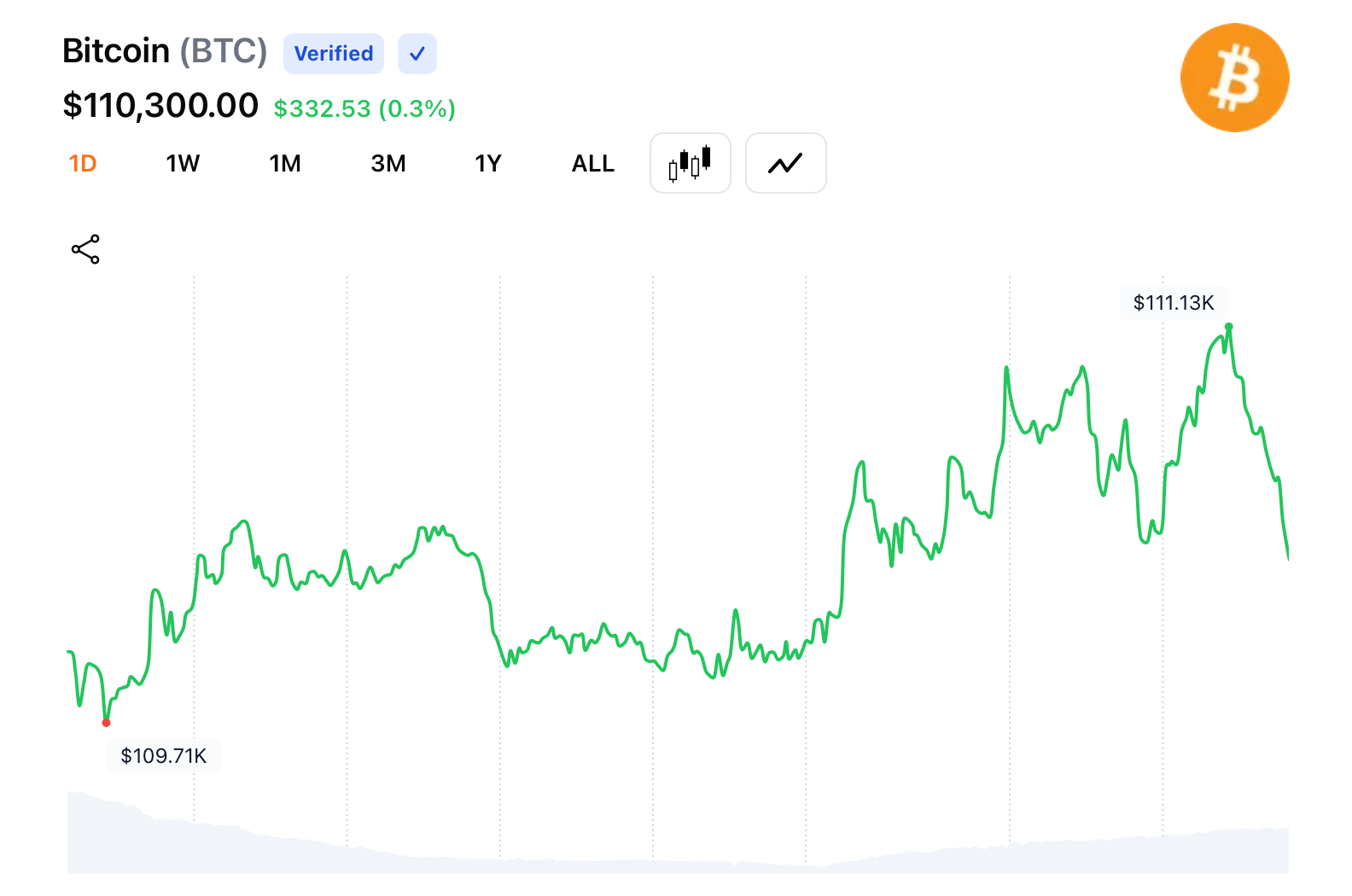

At 8:30 a.m. Eastern on Sunday, bitcoin is trading hands at $110,300, and prediction markets are buzzing with bets on whether the crypto heavyweight will hold its ground—or break new highs—through November.

Polymarket’s November Wager

The popular prediction platform Polymarket is running a hot contest titled “What price will Bitcoin hit in November?” where traders are wagering more than $1.2 million in total volume across outcomes.

The current favorite: a 77% chance that bitcoin stays above $115,000, with “Yes” shares trading at 77¢. That probability jumped five percentage points overnight, showing confidence that BTC will hold tight to its current range.

In the mid-tier brackets, the odds of bitcoin clearing $125,000 stand at 29%, up 4%, while breaking $130,000 has a slimmer 14% probability. Traders see a modest 7% chance of BTC reaching $135,000, and just 4% for a move beyond $140,000. The moonshot bets—like bitcoin hitting $200,000 this month—are treated as long shots, priced at 1% odds with only $482,800 in total volume.

For bears, the action is even thinner. There’s a 34% chance bitcoin could slip below $100,000, but probabilities fall sharply beyond that. Odds of a dip under $95,000 are just 15%, and a fall below $90,000 sits at a timid 10%. Anything south of $80,000 barely registers at 3% or less.

Polymarket traders, in short, are pricing in resilience—not capitulation.

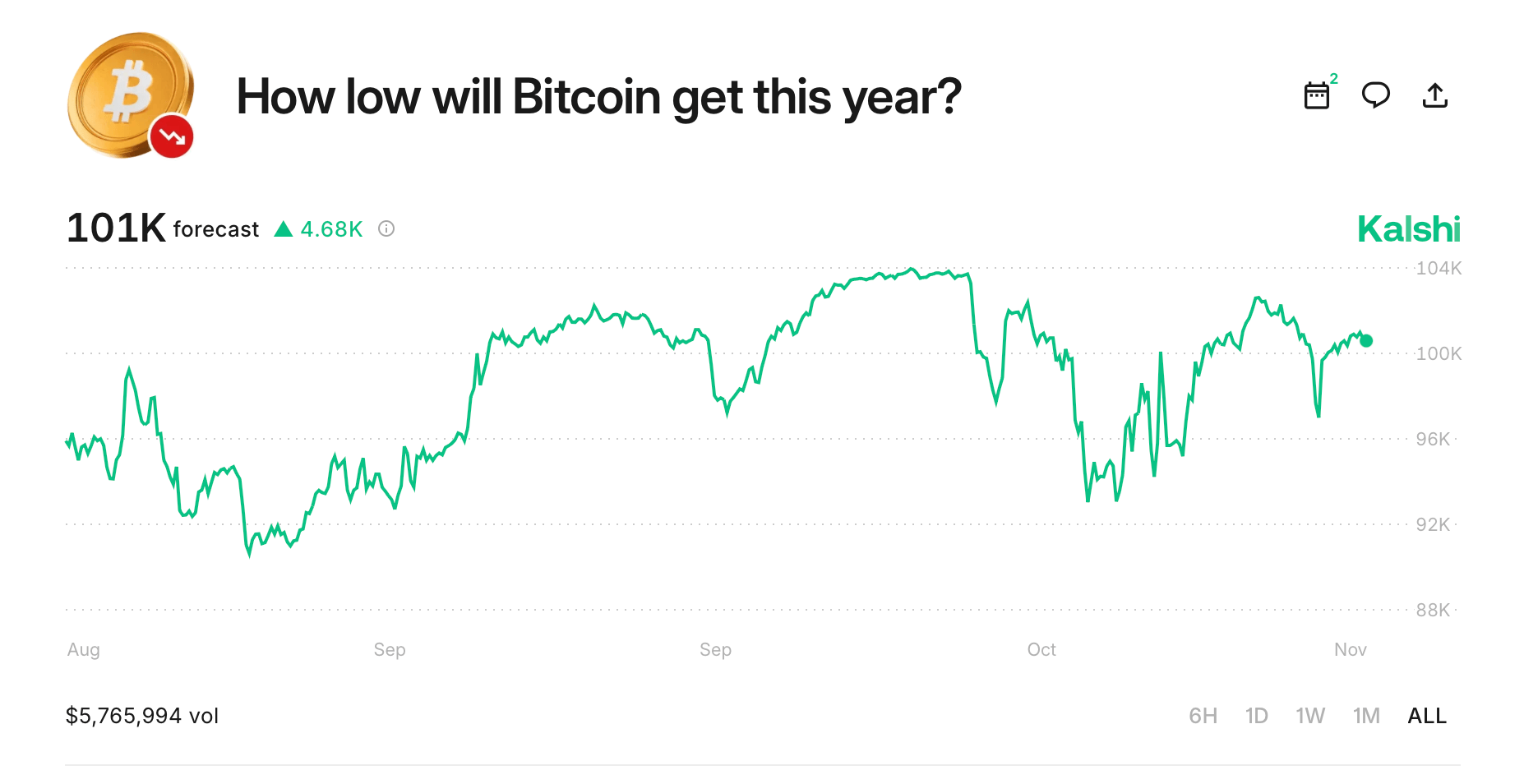

Kalshi’s Year-End Forecasts

Over on Kalshi, the U.S. prediction exchange, traders are looking at a longer horizon through the end of 2025 with the market titled “How low will Bitcoin get this year?” Roughly $5.76 million in total volume is on the line, making it one of Kalshi’s most active crypto markets. The median forecast hovers around $101,000, with probabilities largely stacked against any major breakdowns.

The Kalshi odds imply a 47% chance bitcoin dips below $100,000, down two points this week. Bets on a deeper drop below $90,000 carry only a 20% chance, while sub-$80,000 levels draw a mere 13% probability. Traders see just a 6% chance of BTC tumbling under $70,000, and extreme bearish outcomes below $60,000 or $50,000 are both priced at 4% and 3%, respectively.

In essence, the Kalshi crowd sees a sturdy floor forming near six figures. Bulls dominate both exchanges, with speculative energy focusing on whether bitcoin can not just hold—but expand—its five-digit dominance as the year winds down.

Between Polymarket’s shorter-term optimism and Kalshi’s steadier long-view positioning, traders appear confident bitcoin won’t revisit deep lows this cycle. The probability spreads across both platforms suggest a volatile but upward-leaning November, where the most likely range sits between $105,000 and $125,000.

The current data shows bitcoin traders betting not on meteoric highs—but on sustained strength. With open interest and prediction market volume at record levels, sentiment has shifted from “Will bitcoin moon?” to “How long can it stay this strong?”

FAQ

What are Polymarket traders predicting for bitcoin in November?They’re giving bitcoin a 77% chance of staying above $115,000, with heavy volume backing that outcome.

How much money is being wagered on Polymarket’s bitcoin market?More than $1.2 million in total volume is spread across all November price outcomes.

What’s the forecast on Kalshi for bitcoin’s year-end low? Kalshi traders peg a $101,000 forecast with only a 47% chance BTC dips under $100,000.

Is bitcoin expected to drop below $90,000 this year? Kalshi traders assign just a 20% probability that bitcoin will fall under $90,000 before year-end.