Key Insights:

- Bitcoin Cash (BCH) sustained upside after breaking above the key resistance line.

- On-chain data reveals that 85% of BCH holders were in profit, and large trades were declining.

- Open interest retreats from recent local top, signaling a shift in favour of caution.

Bitcoin Cash has been demonstrating prominence among alts. Especially amid the latest cool-down observed between top cryptos like BTC and ETH. While BCH was not as popular as its counterparts, investors have been quietly accumulating the cryptocurrency.

As a result, Bitcoin Cash has maintained an overall uptrend since April. From a numerical perspective, BCH bottomed out at $249 in April, and it recently surged as high as $608 earlier this week. A 142% upside in the last 4 months.

Zooming out on its price action also revealed that Bitcoin Cash broke above a long-term descending trend line. One that has been active for over 12 months.

This breakout signalled that bullish momentum remained strong as a reflection of aggressive demand.

However, it also raised questions regarding the potential for a natural correction. This is because its MFI signalled declining liquidity inflows. It was worth noting that the cryptocurrency was not yet overbought at press time.

Bitcoin Cash was already up by over 15% in July, and this marked its fourth consecutive month in the green. But the cryptocurrency was still heavily discounted compared to its previous historic top.

Will High Profitability Rate Pave the Way for Profit-taking?

IntoTheBlock data revealed some interesting details about Bitcoin Cash profitability. For example, 85% of all BCH holders were in profit, while 3% were at a profit and only 12% were out of profit.

The data also revealed that 98% of all the holders acquired Bitcoin Cash more than 12 months ago. Only 2% acquired within the last 12 months, and just 1% in the last 4 weeks.

IntoTheBlock also disclosed that whales or large holders accounted for roughly 39% of the total coins in circulation. Meanwhile, activity around the coin cooled substantially in the last few days.

Large transaction volume peaked at $912.1 million, with daily large transactions peaking at 335 transactions on 25 July.

Transactions have since dropped by more than half to about 133 transactions as of 30 July.

The cooling of large transactions was a reflection of investor sentiment after the recent push above the long-term resistance level.

A clear indicator that investors were starting to adopt a more cautious approach. This was also echoed across the market as a result of August uncertainty.

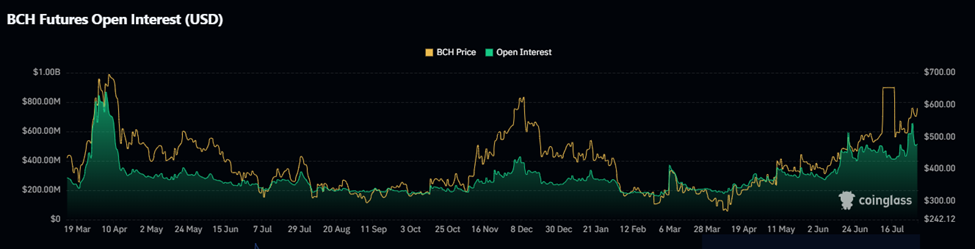

Bitcoin Cash Open Interest Retreats from Local Peak

Bitcoin Cash just experienced its largest spike in open interest since April. Open interest surged as high as $655 million as of 28 July. However, it dropped by about $140 million in the last 2 days.

The slight pullback occurred just after the BCH price pushed above the aforementioned resistance. In other words, it signalled that investors may have exited some of their positions over the rising uncertainty.

On the one hand, BCH achieved an impressive rally since April, which meant it was due for a retracement.

On the other hand, it demonstrated weak sell pressure despite the recent upside. This might have been an indicator that long-term holders were not yet ready to take profits.

The fact that BCH still had a long way to go before retesting its previous top might be one of the reasons for the optimism.

Its low circulating supply, combined with its long-term battle testing, may have been contributing factors to the long-term HODLing sentiment.

Nevertheless, the latest market cooldown underscored uncertainty and risk of disrupted sentiment. Perhaps one of the key takeaways was that BCH might be overshadowed by its more popular counterparts, but it did not deter investors.

If anything, its recent performance was proof that it was one of the coins attracting investors in 2025.