Analyst says Dogecoin is testing a key support zone, showing signs of a potential bullish reversal.

Over the past week, Dogecoin has seen a consistent downward trend, moving from above $0.18 to a low near $0.146. As of June 23, it is trading around $0.153, following a slight bounce.

Despite the 13.28% drop over the last seven days and a 1.56% decline in the past 24 hours, a recent support level in the 1-hour chart, per Landry Anael, suggests a potential shift.

Technical Indicators Highlight Key Support Zone

Dogecoin is currently positioned near a critical support range between $0.14500 and $0.14872, according to the analyst. This area has shown strong resilience, having been tested several times over the past few days. Price action on June 20 and 21 saw downward moves halted at $0.15829 and $0.15009 respectively, signaling the presence of buyers defending this zone.

Further confirming bearish market pressure, the 200-period Simple Moving Average (SMA) on the chart is trending downward and stands at $0.1692. DOGE continues to trade well below this level, suggesting bears still control the broader trend. However, within the support zone, a recent reversal candlestick has formed, indicating a potential short-term bullish reaction.

Based on Anael’s structure, a stop-loss level has been set at $0.14050. Meanwhile, the take-profit target is defined at $0.16169, aligning with a prior resistance zone visible from past price levels. A price move from the current level of $0.1538 to $0.16169 would require a 5.13% gain. According to the analyst, the daily chart also aligns.

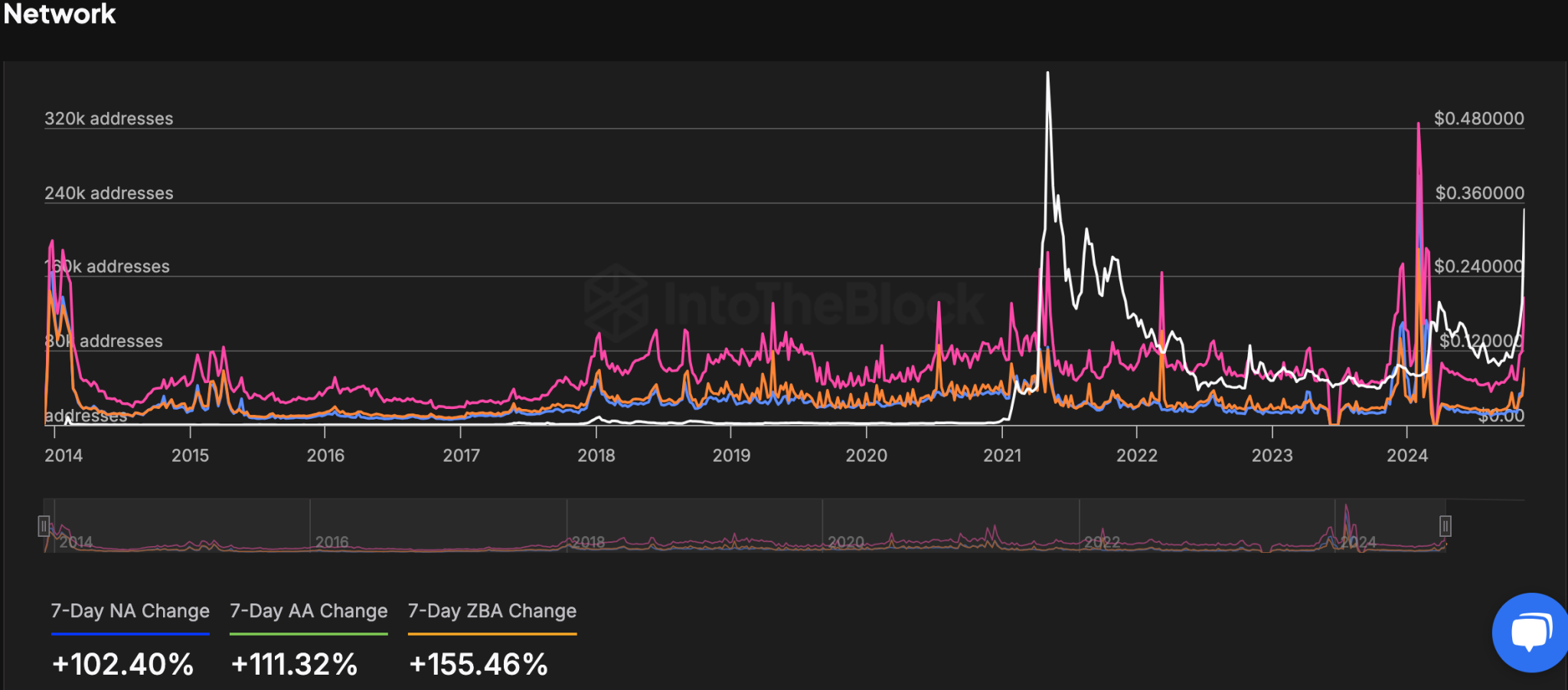

Dogecoin Wallet Activity Shows Strong Growth Across Key Metrics

While technical charts suggest a potential bounce, on-chain wallet metrics point to heightened user activity. In the past seven days, the number of new addresses (NA) has surged by 102.40%.

Similarly, active addresses (AA) rose by 111.32%, and zero balance addresses (ZBA) increased by 155.46%. This growth in participation reflects a broader engagement in DOGE transactions despite recent price weakness.

These changes in address metrics may influence Dogecoin’s near-term momentum, especially as the token holds near its support. Notably, increased activity often precedes directional moves, adding context to current chart behavior.

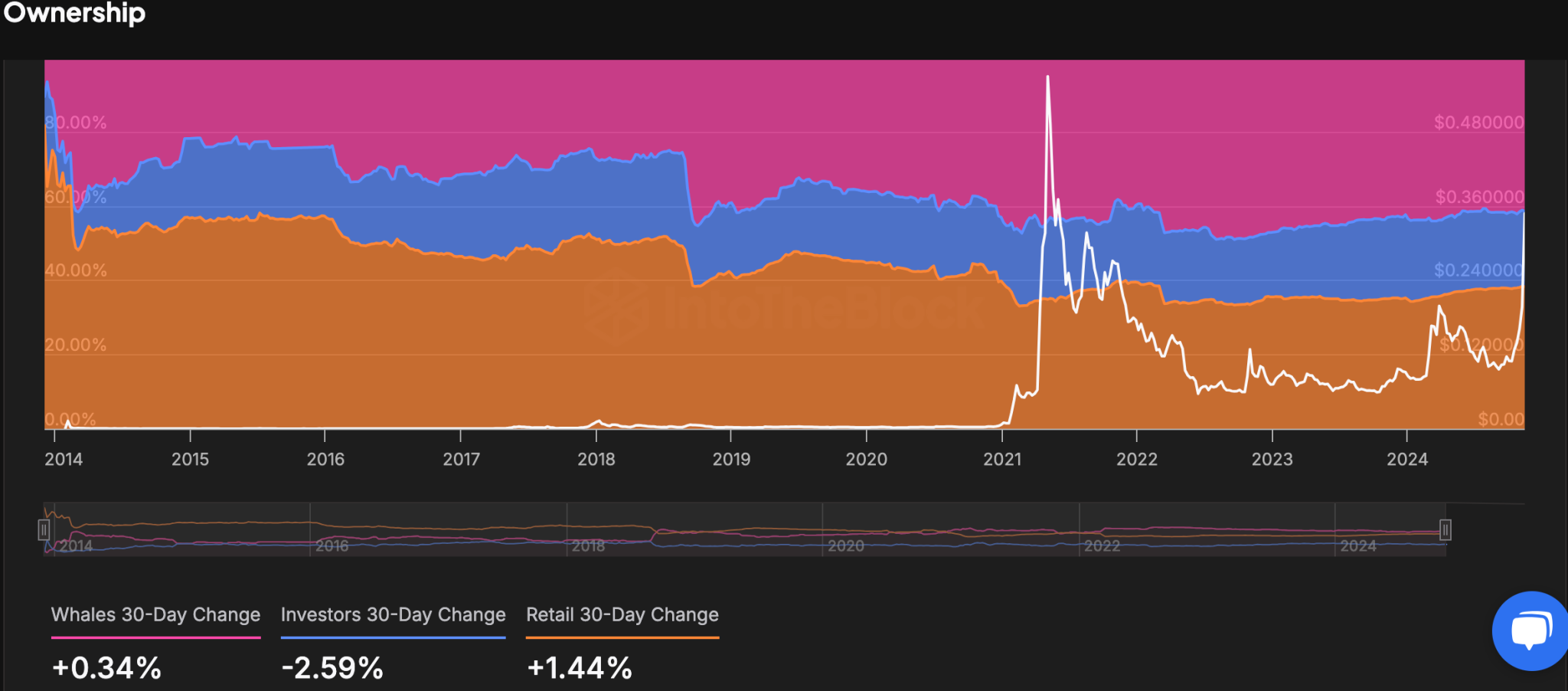

Dogecoin Ownership Data Signals Shift Among Holders

Meanwhile, the latest 30-day Historical Concentration data reveals a shift in DOGE ownership. Large holders, or whales holding over 1% of the supply, increased their positions by 0.34%.

Conversely, mid-tier investors with 0.1%–1% holdings reduced their stake by 2.59%, possibly suggesting redistribution or profit-taking. Retail ownership, representing addresses holding less than 0.1%, grew by 1.44%.