Dogecoin (DOGE) has shown signs of recovery after dropping to a two-month low during a market-wide selloff. The downturn was linked to investor jitters following an escalation in geopolitical tensions between the United States and Iran.

Despite a weekly loss of over 14%, the token has bounced from the key $0.15 support level. A recent break of a short-term downtrend on the hourly chart now has analysts watching for a potential shift in market momentum.

Geopolitical Tensions Trigger Market Sell-Off

According to market analyst Trader Tardigrade, DOGE has managed to break above a descending trendline on the 1-hour chart. This trendline had consistently rejected price attempts to move higher. The breakout occurred at around $0.1510 and was confirmed by a strong bullish candle, signaling increased buyer interest.

While resistance still looms near $0.1560 and $0.1600, the technical structure has improved. The breakout could signal a change in short-term direction if Dogecoin manages to hold above the broken trendline. Traders are watching closely for retests or consolidations near the trendline to validate this potential shift.

#Dogecoin has broken out of a descending trendline in LTF ?$Doge/H1 pic.twitter.com/q2uVPAEq2k

— Trader Tardigrade (@TATrader_Alan) June 23, 2025

Market Sentiment Remains Fragile

Despite the breakout, market sentiment remains cautious. Dogecoin is currently priced at $0.1519, reflecting a 2.14% decline over the last 24 hours. Over the past week, DOGE has dropped more than 14%, highlighting ongoing pressure.

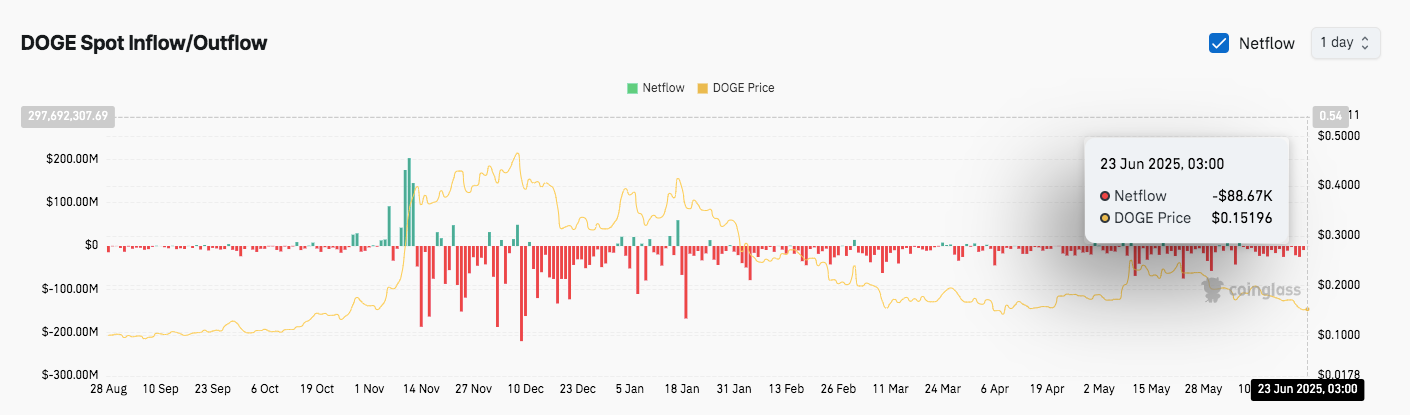

Netflow data shows sustained outflows since mid-November, indicating distribution rather than accumulation. Large outflow events in late 2024 and early 2025 have correlated with steep price drops, adding to investor wariness. Recently, outflows have softened, with a minor $88.67K recorded, suggesting that the sell pressure may be stabilizing.

Related: DOGE Price Prediction: What’s Happening With Dogecoin’s Price?

Indicators Show Oversold Conditions

Key indicators are now flashing oversold signals. The Relative Strength Index (RSI) stands at 27.88, placing it well below the 30 threshold. Historically, such low RSI levels have often preceded short-term price bounces.

Additionally, the MACD shows a bearish crossover, with both the MACD and signal line below zero, reinforcing the market’s current weakness. However, any uptick in momentum or a positive crossover could serve as an early sign of recovery.

Related: Dogecoin Gears Up for a Potential Breakout, Analysts Eye $2.28 Target

Looking ahead, Coincodex analysts predict Dogecoin could end the year trading between $0.159 and $0.176. If this outlook holds, current buyers could realize up to 15% in potential gains. For now, all eyes are on whether Dogecoin can hold above $0.15 and sustain its breakout in the days to come.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.