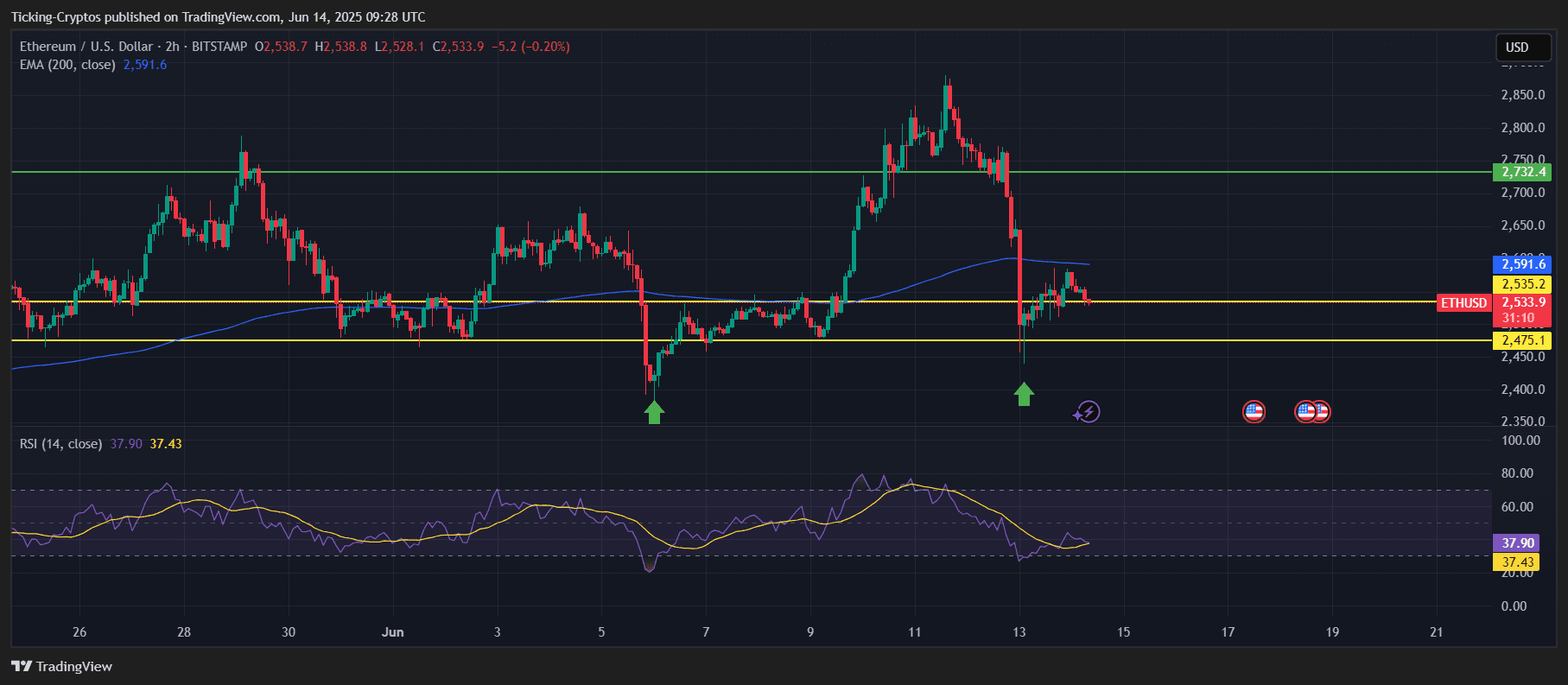

Ethereum is showing all the signs of being the next big institutional play. In the past weeks, BlackRock and other major ETFs have accumulated $240 million worth of ETH, even before the Ethereum spot ETF officially launches. But they’re not just positioning for the spot ETF. Institutions are preparing for the future SEC approval of staking-based ETFs, which would allow them to offer yield-generating products. If approved, this would be a game-changer: Looking at the chart, Ethereum is trading around $2,533, just above the key support level at $2,475. The price has bounced from this level twice, showing it's acting as a strong demand zone. ETH/USD 2-hours chart - TradingView However, the 200 EMA at $2,591 is acting as a ceiling. ETH must break above this level to confirm momentum and enter a bullish continuation. The RSI on the 2-hour timeframe sits around 37.90, slightly oversold, which means the downside is limited unless support breaks. Key levels: The path to $10,000 ETH won’t happen overnight, but the foundation is already being laid: By the time retail FOMO kicks in, ETH could already be halfway there.Ethereum to $10K: The Institutional Bet Is On

The Real Target: ETH Staking ETFs

ETH Chart Analysis: Support Still Holding

Ethereum Price Prediction: Road to $10,000

Ethereum to $10,000 in 2025? Why Institutions Are Betting Big on ETH