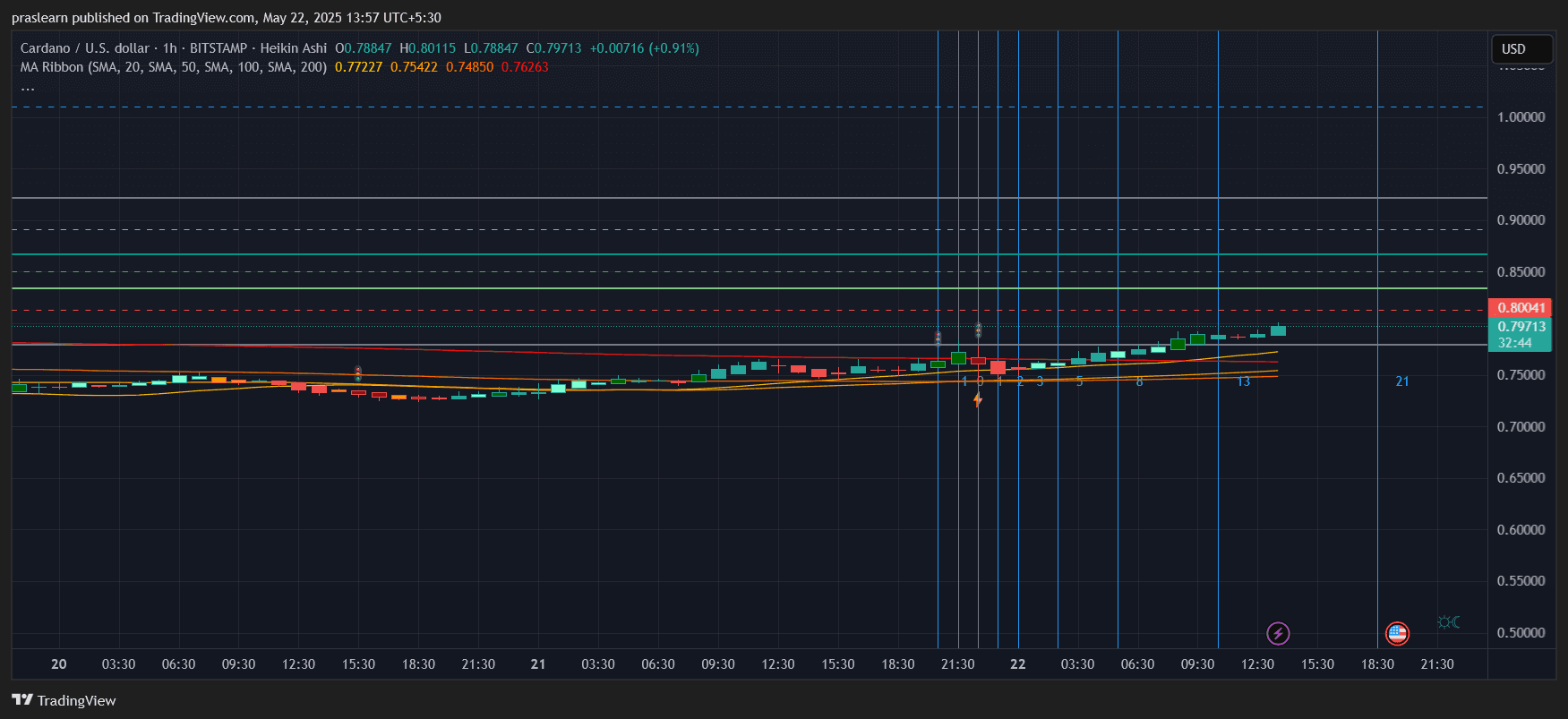

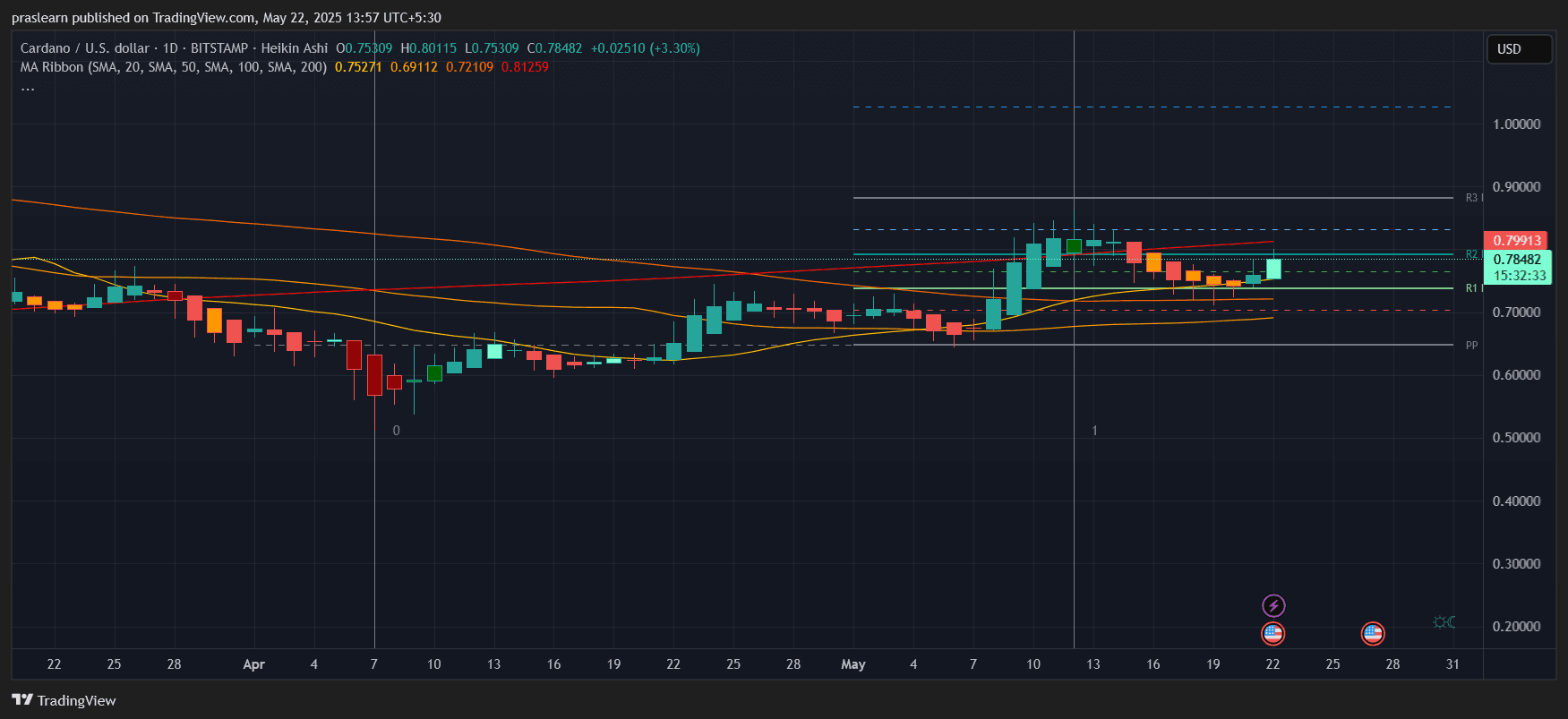

Cardano (ADA) price is showing signs of a fresh breakout after a phase of consolidation. On the daily chart, the price closed at $0.78482, marking a 3.3% gain for the day. This green Heikin Ashi candle with a long body and no lower wick signals bullish momentum. Notably, ADA price has reclaimed both the 20-day and 50-day moving averages and is now pressing against the 100-day SMA at $0.79913, which has acted as a stubborn resistance. This breakout attempt comes after a minor pullback last week where Cardano price briefly retested support near the $0.72 zone, corresponding to pivot support (S1) and the 50-day SMA. The bounce from that level created a higher low pattern—a key bullish signal. The hourly chart reveals Cardano price consolidating above its major moving averages (20, 50, 100, and 200 SMA) with increasing candle volume. Currently trading around $0.79713, the hourly chart shows ADA moving in a narrow ascending channel, suggesting accumulation before a larger move. Using pivot levels from both charts: Yes. On the daily chart, ADA price is trading above the 20-day ($0.75271) and 50-day ($0.69112) SMAs. These crossovers often attract trend-following buyers. Additionally, the 200-day SMA at $0.81259 is now in focus. If ADA breaks and holds above this level, the medium-term bias will flip strongly bullish. Let’s validate this move using a moving average ribbon compression breakout. Between May 10 and May 20, the 20, 50, and 100 SMAs were tightly compressed. Historically, such squeezes lead to sharp moves. The current price action confirms a post-compression expansion—typically bullish. Using Fibonacci retracement from the April swing high ($0.89) to the May low ($0.67), ADA price recently reclaimed the 61.8% retracement level at ~$0.79, which is significant. This level often acts as a magnet for price action. From a risk-reward standpoint: This gives a reward of $0.08–$0.11 versus a risk of $0.06, resulting in an R:R ratio of 1.3 to 1.8, which favors the bulls. If Cardano price sustains above the $0.78–$0.80 range for the next 24–48 hours, momentum traders could push it toward $0.86 quickly, especially if Bitcoin remains above $68,000. Any break and close above the $0.81259 (200-day SMA) would confirm a long-term reversal pattern. However, failure to break $0.80 convincingly could result in a retest of $0.75. If that level fails, ADA price may revisit $0.72—but that scenario currently seems unlikely given the increasing bullish volume and strong Heikin Ashi candles. Cardano news today is showing early signs of a new upward leg. If bulls clear the $0.80 barrier, ADA could rally toward $0.86 and beyond. Keep an eye on volume spikes and moving average support to confirm the breakout.Cardano News Today: What Are the Key Resistance and Support Levels?

Is This Rally Backed by Volume and Moving Averages?

What Do Fibonacci and Risk-Reward Say?

Cardano News Today: What’s the Cardano Price Prediction for the Week Ahead?

Conclusion

ADA Breakout Imminent? Cardano News Today Signals Bull Run!

ADA/USD 1 Hr Chart- TradingView

ADA/USD 1 Day Chart- TradingView