- Bitcoin hits the $100K mark and keeps rising as more people join the network and trade.

- Over 800,000 wallets are still active daily, showing strong interest and regular use.

- The pioneer cryptocurrency has surpassed Amazon and emerged as the 5th-largest asset.

Bitcoin has officially reclaimed the $100,000 spot, marking a powerful comeback after months of market turbulence. The digital asset, which initially crossed $100K in December 2024, surged as high as $109,000 in January 2025, shortly after Donald Trump resumed the U.S. presidency. His market-friendly rhetoric and early policy signals briefly fueled optimism across the crypto space. With the ascent of BTC, it has secured the 5th spot among global assets.

JUST IN: #Bitcoin surpassed Amazon to become the 5the largest asset in the world ? pic.twitter.com/9j2XCLyQvC

— Bitcoin Magazine (@BitcoinMagazine) May 8, 2025

Indicators Point to Structural Strength Behind $100K Rally

The move above $99,474 on May 8 is not just an extreme nerve response from the bulls. It had technical and on-chain backing. It is also worth noting that the Bitcoin price held and reversed at a key Fib level from the low of $74,588 and the high of $99,474. The levels of 0.382 at $89,968, 0.5 at $87,031, and 0.618 at $84,095 were valid pullback points in April.

Source: TradingView

Additionally, the Relative Strength Index (RSI) closed in at 69.98, just shy of overbought territory. This showed strong bullish momentum without the usual signs of exhaustion. Volume has steadily increased along with price, supporting the legitimacy of the move. Bitcoin has also traded consistently inside a steep ascending channel, forming higher highs and higher lows throughout its rally.

Related: BTC Hits $97K After CME Gap Fill and Futures Activity Surges

On-Chain Activity Signals Strong Network Growth

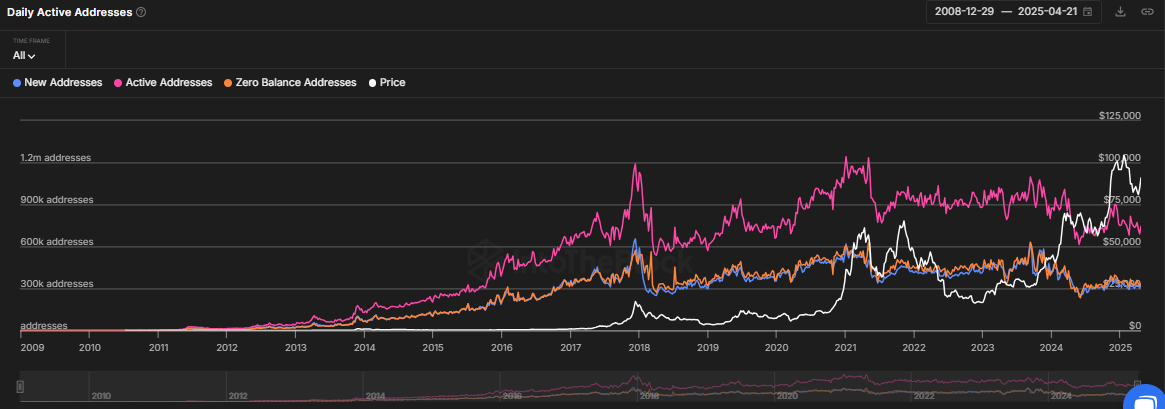

Further, looking at a broader perspective, the token, in terms of network fundamentals, as analyzed by blockchain analytics firm IntoTheBlock, is buttressed by the rising prices of the digital coin. The current active address is above eight hundred thousand since early 2023, indicating high user activity. Such fluctuational balance of daily participation reflects similar trends seen before the start of any historical bull or bear markets.

Source: IntoTheBlock

The latest addresses show strength, with daily counts between 300,000 and 400,000 since late 2024. This trend reflects user onboarding despite market volatility, as it sets a picture of long-term investor interest. Additionally, zero-balance addresses have surpassed 1.1 million in 2025, a sign of transaction churn and increasing wallet turnover. Historically, spikes in active and new addresses have coincided with price rallies, such as the 2021 and 2024 bull markets. The close correlation of rising address activity with price lends credence to the bullish case today. The on-chain metrics now exhibit patterns similar to prior instances of breakout by Bitcoin, which implies there could be another one very soon.