Regulators are raising red flags over the skyrocketing trading volumes of the memecoin platform Pump.Fun, warning it could be a Ponzi scheme. The meteoric rise of Pump.Fun, and similar platforms, represents the darker side of the cryptocurrency market, where innovation and opportunity give way to manipulation and exploitation. As 2025 unfolds, Pump.Fun’s tactics serve as a stark reminder of the ongoing threat posed by crypto Ponzi schemes, which have proliferated over the past two years.

Memecoins, the digital tokens that have gained immense popularity in recent years, often masquerade as part of the cryptocurrency revolution. Platforms like Pump.Fun take this narrative further, presenting themselves as innovative blockchain projects. However, beneath the surface lies a disturbing truth: these tokens are thinly veiled multi-level marketing (MLM) schemes, capitalizing on human desperation and the viral nature of the attention economy.

At their core, memecoins like those on Pump.Fun operate on an exploitative model. Early adopters profit by recruiting others into the system, cashing out once prices rise on the backs of new participants. The value of these tokens, far from being rooted in utility or technological advancement, is tied to the number of people lured into the scheme. This is not innovation; it is financial manipulation, repackaged for the digital age.

Pump.Fun’s marketing strategies reveal the insidious nature of its operations. Through social media campaigns, the platform promises wealth, freedom, and an escape from financial struggles. It appeals particularly to young people and financially vulnerable individuals, selling the illusion of opportunity. Posts glorify the idea of recruiting friends and exploiting their trust, framing this behavior as “fun.” One particularly egregious post mocks disadvantaged individuals, referring to them as “exit liquidity”, a chilling euphemism for victims.

These schemes prey on hope and desperation, turning them into commodities for the enrichment of a select few. For many participants, the dream of financial freedom quickly becomes a nightmare of loss and betrayal. The human cost of memecoins extends beyond financial ruin, damaging trust and relationships in the process.

Biggest Ranking Ponzi Schemes as of 2025

1. OneCoin

One of the largest cryptocurrency Ponzi schemes, OneCoin, swindled $4 billion by luring individuals with promises of substantial returns on their crypto investments, positioning itself as a legitimate enterprise.

The Bulgarian founder, Ruja Ignatova, vanished in October 2017 without leaving a trace and is now sought by U.S. authorities for allegations of fraud and conspiracy. She remains the only woman on the FBI’s Ten Most Wanted List, a distinction held by only 11 women in history. If found guilty, she could face a prison term of up to 20 years.

Court filings reveal that Ignatova duped unsuspecting victims—whom she allegedly called “fools”, out of billions, claiming OneCoin would surpass Bitcoin. The company’s main operation, however, was selling educational materials, and there was no genuine blockchain. The currency ran solely on an SQL database.

After Ignatova disappeared, her brother, Konstantin Ignatov, assumed leadership but was detained in 2019 and later admitted to charges of fraud and money laundering.

2. Thodex

Established in 2017, Thodex was a Turkish cryptocurrency exchange that collapsed in April 2021, taking with it more than $2 billion of investors’ funds. Founder and CEO, Faruk Fatih Özer, initially claimed trading was halted due to cyberattacks and assured users their money was secure, before fleeing.

Turkey launched an investigation into Özer, accusing him of orchestrating a scam and founding a criminal syndicate. Dozens of employees were apprehended, and authorities confiscated company computers. Interpol issued a red notice, requesting global law enforcement to track and detain him.

In September 2022, Özer was apprehended in the Albanian city of Vlorë. As per blockchain forensics firm Chainalysis, this fraudulent centralized exchange was responsible for approximately 90% of all rug-pull-related losses in 2021.

Local reports indicate prosecutors are demanding a staggering

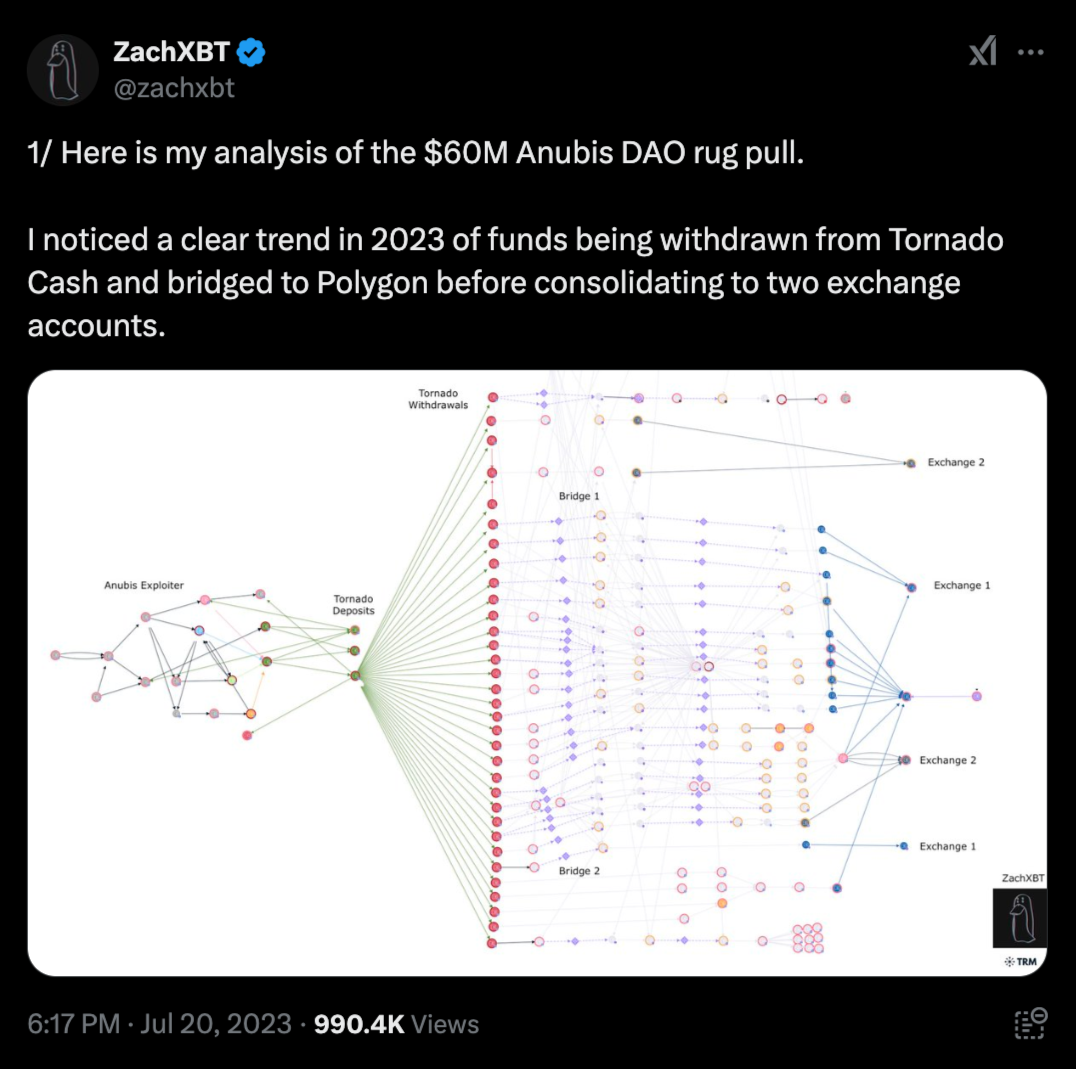

3. AnubisDAO

The AnubisDAO project, centered around a dog-themed token, raised $60 million worth of ETH (13,597 ETH) from investors in exchange for its native ANKH tokens. Less than 24 hours after the project’s inception, funds were transferred to an unknown wallet, leaving investors empty-handed.

With no liquidity left, the ANKH token’s value plummeted to zero.

Promoted as a spin-off of OlympusDAO, a decentralized reserve currency project, AnubisDAO launched with just a Discord server and a now-defunct Twitter account, lacking a website or white paper. Its developers remained anonymous, using aliases.

Blockchain analytics firm Chainalysis highlighted AnubisDAO as a warning example for investors, emphasizing the importance of code audits for new tokens.

4. Squid Game (SQUID) Token

Among the most infamous rug-pulls in crypto history was the Squid Game (SQUID) token, introduced on Binance Smart Chain in 2021 and heavily publicized. This scam raised $3.3 million by leveraging the global popularity of Netflix’s “Squid Game.”

Developers drained the token’s liquidity pools, fleeing with investors’ funds.

Solidus Labs, a blockchain security firm, revealed that 12% of all tokens on the BNB Chain were scams, with SQUID being the most notable example of a honeypot exploit. Its smart contract appeared as a rapidly appreciating meme coin but trapped users from selling their tokens.

The project’s website was filled with grammar mistakes and included an anti-dump mechanism. A Twitch streamer caught the rug-pull live, showing the token’s market cap collapsing from $2.2 trillion to near-zero instantly. As of now, SQUID trades at $0.0096, down over 96% from its peak.

5. Mutant Ape Planet (MAP) NFTs

The creator of the Mutant Ape Planet (MAP) NFT collection, a counterfeit version of the renowned Mutant Ape Yacht Club (MAYC, executed a rug-pull, swindling $2.9 million. Aurelien Michel, a 24-year-old French national residing in the UAE, was recently arrested and charged with fraud at John F. Kennedy Airport in New York.

Michel and his team marketed their NFTs with promises of perks like rewards, exclusive access to crypto assets, and funding for marketing from a community wallet. They also vaguely mentioned acquiring virtual real estate in the metaverse, none of which materialized. Once the NFTs sold out, the funds were redirected to wallets under Michel’s control. He reportedly confessed to the scam on Discord using the alias “James.”

Blockchain investigator ZachXBT uncovered Michel’s involvement in additional schemes, including Fashion Ape NFT and Crazy Camels, netting millions of dollars.

Lessons from Pump.Fun and Crypto’s Cultural Failures

The glorification of memecoins and platforms like Pump.Fun reflects a deeper cultural failure to distinguish innovation from exploitation. These schemes are often celebrated as entrepreneurial ventures, with their creators lauded as savvy disruptors. In reality, they represent the worst of human behavior—greed, manipulation, and a willingness to exploit others for personal gain.

Allowing these platforms to thrive undermines the core principles of blockchain technology: transparency, fairness, and empowerment. Memecoins are not part of crypto’s future; they are a distortion of its promise, serving as a stark reminder of the dangers of unregulated markets.

To combat the rise of crypto Ponzi schemes, the narrative around cryptocurrency must change. The industry needs to draw a clear line between legitimate projects and exploitative schemes. Education is key—investors must be made aware of the risks associated with memecoins and the tactics used by platforms like Pump.Fun.

Regulatory bodies must also step up their efforts, implementing measures to identify and shut down fraudulent projects before they cause widespread harm. Collaboration between governments, crypto platforms, and the broader community is essential to restoring trust in the market.

The rise of Pump.Fun is a cautionary tale for the cryptocurrency market. It exemplifies the dangers of unregulated platforms and the human cost of financial exploitation. As regulators sound the alarm, the industry must take a hard look at its vulnerabilities and work toward creating a safer, more transparent ecosystem.

The story of Pump.Fun is not unique, but it is a powerful reminder of what’s at stake. By addressing the root causes of crypto Ponzi schemes and holding bad actors accountable, the industry can begin to fulfill its promise of innovation, fairness, and empowerment for all.