Cryptocurrencies recorded notable gains over the past day as Bitcoin displayed strength above $105,000.

With experts predicting massive growth for the crypto industry under the new US government, attention has shifted to different projects.

Let’s check Arbitrum’s current trends and what to expect in the coming sessions.

Arbitrum’s potential breakout

ARB changes hands at $0.7239 after gaining nearly 7% within the past day.

The alt signals a potential bull comeback amid enhanced broad market sentiments.

ARB price hovers at a crucial juncture as it consolidates near vital support barriers.

Thus, it has attracted attention as enthusiasts anticipate the next move.

Arbitrum has its price actions inside a definitive descending triangle formation, a pattern often linked to possible explosive upsurges.

Rose Premium Signals forecasts an initial move to $1.0690 upon the descending triangle’s breakout.

? $ARB is showing a bullish recovery setup ? #ARB Descending Channel breakout expected, aiming for upside targets ? ?1TP: 1.0690$ ?2TP: 1.3053$ ?3TP: 1.5804$

Stability above the trendline would support extended gains to $1.3053 and $1.5804.

Attaining these targets would mean an approximately 118% upswing from ARB’s current price.

Levels to watch during ARB’s likely breakout

Arbitrum’s chart displays bearish sentiments, reflecting the selling wave that swept the token from weekend highs of $0.829 to $0.6707 on Monday.

Meanwhile, ARB consolidates around the foothold at $0.6890 – which remains crucial for price stability.

Weakness around this region could trigger declines towards the psychological level at $0.6500.

Bulls will have to defend this support to prevent relentless declines.

Upside actions from the current values will target the nearest resistance at $0.78.

The downward trendline has rejected further gains at this level several times.

Overcoming the obstacle might trigger extended gains to FIB retracement levels 0.618 ($0.8661) and 0.786 ($0.9077).

Decisive breakouts past these obstacles could catalyze surges past the sought-after $1.

Worrying signals to consider

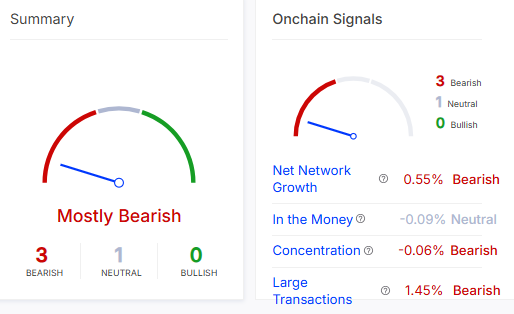

While enthusiasts anticipate breakouts in the near term, on-chain data and indicators suggest delayed revivals.

IntoTheBlock data highlights notable bearish momentum, with none of the four metrics flashing positive trends.

Net network growth suggests reduced activity from new participants, likely due to the declined profitability.

IntoTheBlock details show over 80% of Arbitrum investors are enduring losses at current prices.

Large transactions have dipped, signaling dwindled interest from whale participants.

The diminished concentration confirms faded enthusiasm from dip-pocketed investors, matching the ongoing price consolidations.

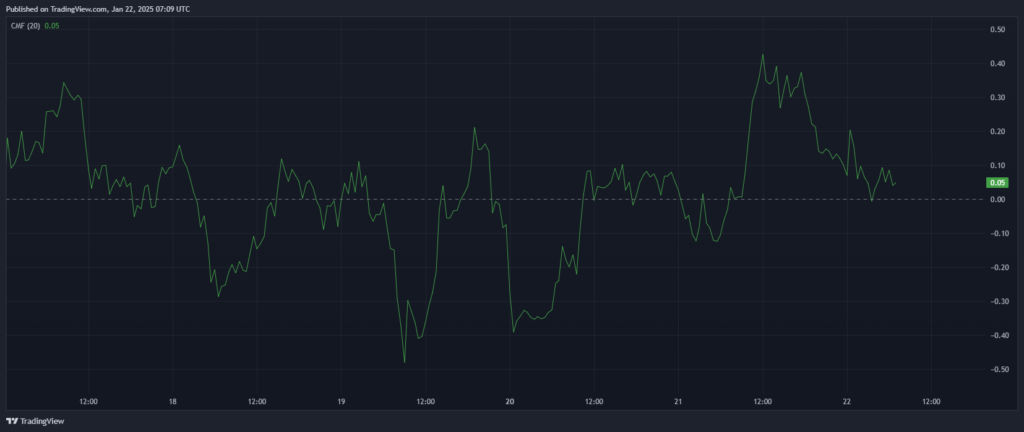

Technical indicators correlate with ARB’s near-term bearish stance.

The daily Relative Strength Index sways just above the oversold region, reading 44 at press time.

The indicator indicates weak momentum, with zero hints of bullish divergence signifying seller dominance.

Furthermore, the Chaikin Money Flow plummeted from yesterday’s 0.42 to 0.04 at press time.

That highlights reduced money entering the ARB ecosystem. Such trends could hinder solid rallies amidst breakout.

Arbitrum’s trajectory will depend on its capability to claim and steady above the $0.68 mark.

This move will likely renew buyer interest in the alts to support the anticipated breakout rallies beyond $0.78.

The post Arbitrum’s (ARB) price prediction: mapping path for potential 120% surge after channel breakout appeared first on Invezz