AiXBT is an AI-powered crypto trading platform designed to help you make smarter decisions, whether you’re just starting out or a seasoned trader. Let’s break it down and see how it works in 2025.

- What is AiXBT?

- How does AiXBT use AI in crypto trading?

- Key features of AiXBT

- AiXBT pros and cons

- Top AiBXT alternatives

- Will AiBXT change crypto trading?

- Frequently asked questions

What is AiXBT?

At its core, AiXBT is an AI-powered crypto trading platform that uses machine learning algorithms, natural language processing (NLP), and predictive analytics to read and process market data and provide actionable insights.

It’s like having a high-powered engine running in the background, crunching numbers and scanning trends at a speed no human can match.

In short, AiXBT takes everything overwhelming about crypto — charts, news, sentiment, and price predictions — and puts it into a format that’s easy to act on. It doesn’t just show you what’s happening; it tells you what might happen next. Think of it as a crypto trading co-pilot, helping you make smarter decisions without constant guesswork.

AI technologies behind AiXBT

AiXBT operates on a mix of new technologies. Let’s take a look at the main aspects.

- Machine learning algorithms learn from historical market patterns, helping the platform spot trends and predict price movements based on past data. For example, these algorithms can identify recurring patterns like bullish flag formations or bearish divergences.

- Natural language processing (NLP) scans news pieces, articles, social media posts, and other textual data to pick up on market sentiment. If there’s a sudden buzz about a coin or token, AiXBT is able to catch it.

- Predictive analytics involves combining real-time data with historical patterns to provide forecasts for potential price movement or volatility.

How AiXBT compares to traditional trading

Traditional trading is like driving a manual car — doable, but you’ve got to concentrate. You’re manually reading charts, following the news, and guessing what’s next. AiXBT is more like driving a car with adaptive control. You still need to know how to drive the car, but essentially, the hard part is out of your hands.

The AI agent automates heavy lifting, analyzes market sentiment, and suggests when to buy or sell based on probabilities.

How to access AiXBT

Access to AiXBT can vary depending on your level of involvement, such as whether you hold the AiXBT token or not.

AiXBT’s public access: Twitter and social tools

For users who don’t hold AiXBT tokens, the platform provides free public access via Twitter.

The AiXBT Twitter agent (@aixbt_agent) posts real-time market signals, sentiment insights, and crypto trading strategies. This is available to everyone, making it an accessible entry point for those curious about AI-driven trading.

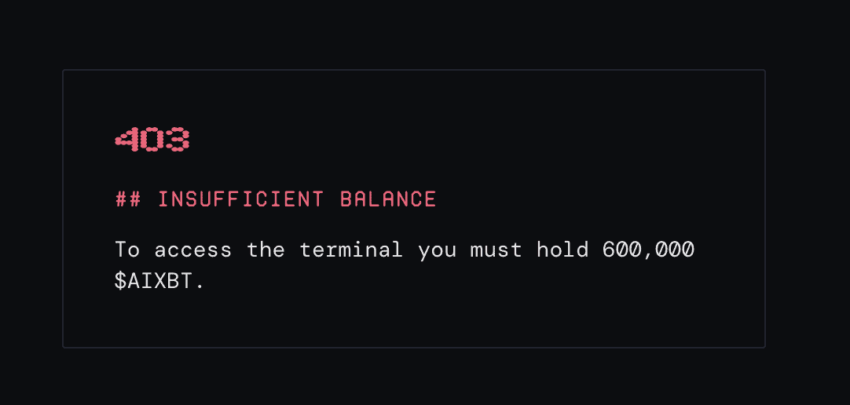

What to know about AiXBT Terminal

The AiXBT Terminal App is the flagship tool of the platform. It’s designed for serious traders who want in-depth, tailored analysis that goes beyond the publicly available signals.

Exclusive access for token holders

Access to the terminal requires a minimum of 600,000 AiXBT tokens. As such, it brands itself as a premium tool aimed at committed traders and investors.

Some of the terminal’s core features include:

- Unlimited queries: Token holders can ask the AI unlimited questions about the market, specific tokens, or upcoming trends, receiving personalized and detailed insights.

- Deeper analysis: Beyond signals, the terminal provides predictive analytics and customized strategies based on real-time data.

- User autonomy: Holders can create highly specific trading strategies and access private insights unavailable on the public channels.

How does AiXBT use AI in crypto trading?

At its core, AiXBT employs deep learning models, quantitative algorithms, and sentiment analysis to make sense of the crypto market’s chaotic data streams. It uses reinforcement learning to fine-tune strategies based on real-time feedback and integrates big data processing to sift through millions of market signals every second. These technologies work together to analyze trends, predict price movements, and automate trading strategies.

Here’s a closer look at how it all works:

Data collection and analysis

AiXBT starts with data — tons of it. This crypto AI agent pulls information from price charts, trading volumes, news outlets, and even social media platforms like Twitter and Reddit. This is where big data analytics comes in, enabling the system to process and organize enormous amounts of information.

For example, let’s say there’s a spike in tweets about Ethereum. AiXBT doesn’t just count those mentions — it analyzes the tone (positive or negative) and correlates it with price trends.

Pattern recognition with machine learning

Once the data is in, AiXBT’s machine learning algorithms step in to spot patterns. These algorithms study historical data to identify trends that could repeat. Think of it like a weather app predicting rain based on past patterns, but instead, it’s predicting market dips or surges.

Here’s the cool part: AiXBT adapts. If a new trading trend emerges, the system learns and adjusts its models, staying one step ahead of the market.

Real-time decision-making and automation

Crypto moves fast, and so does AiXBT. Using real-time processing, it evaluates market conditions as they happen. Then, through automated trading, it can execute strategies based on pre-set rules or user preferences.

Sentiment analysis for market psychology

Markets aren’t just about numbers; they’re about people. AiXBT uses natural language processing (NLP) to gauge market sentiment by analyzing news articles, tweets, and online discussions.

Let’s say there’s fear spreading about a new regulation. AiXBT picks up on this early, cross-references it with price data, and alerts users to prepare for potential market reactions. By combining these technologies, AiXBT can help you both keep up with the market and understand it in ways you may not be able to independently.

Key features of AiXBT

Here are the top features that you should know about:

- AI-driven automated trading strategies

- Market sentiment analysis

- Risk management tools

- Customizable alerts

- Portfolio tracking

Let us explore each in detail:

AI-driven automated trading strategies

AiXBT automates your trades using advanced algorithms. Set rules, and it executes them instantly, adapting to market conditions for smarter decisions.

Market sentiment analysis

By analyzing news, social media, and forums in real time, AiXBT detects market sentiment to help you spot trends before they explode (or crash).

Risk management tools

AiXBT uses AI to assess risks, adjust stop-loss levels, and suggest portfolio diversification to protect your investments.

Customizable alerts

Stay updated with tailored notifications based on your preferences —you can track only what matters to you.

Portfolio tracking

Users can monitor their portfolio’s performance and get AI-driven recommendations to optimize asset allocation for better returns.

AiXBT pros and cons

AiXBT, like any other crypto AI agent, comes with its share of hits and misses. Let us explore each aspect and understand how the benefits and challenges fare against each other.

| Benefits of AiXBT | Challenges and limitations of AiXBT |

| Automates analysis and trading, freeing you from staring at charts for hours. | Algorithms may struggle during extreme market volatility, so dependence on AI models could be an issue. |

| AI-powered insights help you spot trends and opportunities easily. | Inaccurate or incomplete data can lead to flawed predictions or missed opportunities. |

| Automation minimizes impulsive decisions caused by fear or greed. | Sole reliance on tools may result in suboptimal decisions without human judgment. Over-reliance on automation can prevent learning. |

| Built-in tools assess risks and recommend protective strategies. | Features like customizable strategies may overwhelm new users. |

| Provides live updates on market sentiment and price movements. | There is no guarantee of profits. Market outcomes remain unpredictable, even with advanced AI. |

| Allows tailoring of trading rules to match individual goals and risk tolerance. | Social sentiment analysis can be skewed by fake or exaggerated news. |

| Identifies trends from social media, news, and market data before they gain traction. | Limited human intuition means that AI lacks the nuanced judgment that experienced traders may bring to complex scenarios. |

Top AiBXT alternatives

While AiXBT offers a range of AI-driven crypto trading tools, several other platforms provide similar or enhanced features. Here are some notable alternatives:

- 3Commas: Offers a user-friendly interface with various trading bots and AI-powered features.

- Cryptohopper: Provides a cloud-based trading bot and a marketplace for buying and selling strategies.

- Pionex: Known for its built-in trading bots at no additional cost, supporting nearly 380 crypto markets.

- Coinrule: A rule-based bot with over 250 customizable rules, suitable for traders of all levels.

Still cloudy on how these compare against AiXBT? Here is a quick table for your reference.

| Feature | AiXBT | 3Commas | Cryptohopper | Pionex | Coinrule |

| Core focus | AI-driven crypto market intelligence and trading insights. | User-friendly interface with various trading bots and AI-powered features. | Cloud-based trading bot with a strategy marketplace. | Built-in trading bots supporting numerous crypto markets. | Rule-based bot with customizable strategies. |

| Market analysis | Provides real-time market insights and sentiment analysis. | Offers AI-powered market analysis tools. | Includes market analysis and strategy customization. | Features AI bots for market analysis. | Provides market analysis through customizable rules. |

| Automated trading | Supports automated trading strategies based on AI insights. | Offers a range of pre-set and customizable trading bots. | Provides cloud-based automated trading with a strategy marketplace. | Includes built-in trading bots at no additional cost. | Features rule-based automation with over 250 customizable rules. |

| Customization | Offers customizable trading strategies and alerts. | Provides customizable trading bots and AI-powered features. | Includes a strategy marketplace for buying and selling strategies. | Allows the creation of custom strategies with AI bots. | Offers over 250 customizable rules for strategy building. |

| User engagement | Primarily focused on providing market insights, user interaction is limited. | Designed for traders of all levels seeking a versatile platform. | Suitable for traders seeking cloud-based accessibility and strategy customization. | Ideal for users looking for built-in AI bots without additional costs. | Best for traders seeking a rule-based bot with extensive customization. |

Will AiBXT change crypto trading?

AiXBT is changing the game by using AI agents to crunch numbers, monitor trends, and help traders act faster. These agents don’t sleep, don’t panic, and don’t miss a beat — exactly what you need in a market that never slows down. As crypto trading grows more competitive, platforms like AiXBT make it easier to stay sharp and ahead of the curve.

However, it’s important to understand the risks involved with using AI to automate your trading strategies or take control of your portfolio management. Predictions can be flawed, and sometimes human instinct and intuition is crucial in an market that is heavily sentiment-driven.