Amid broad market uncertainty over the past two weeks, there have been lingering questions over Bitcoin‘s price trajectory.

Following the Federal Reserve’s projections of fewer than previously expected interest rate cuts in 2025, the asset has dropped from highs above the $106,000 price point to lows around the $92,000 price point, raising questions among some about the continuation of its bull run.

Recently, one prominent market analyst has suggested that despite the growing uncertainty, Bitcoin could be replicating a pattern that it often has in parabolic runs while noting that a deeper correction may be required before a rally to new highs.

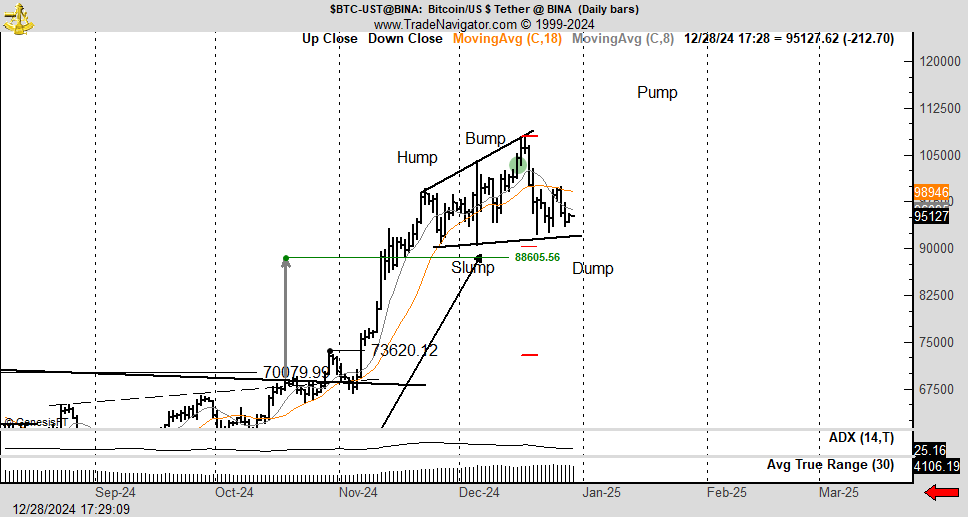

“Hump Slump Bump Dump Pump”

According to Veteran trader Peter Brandt, Bitcoin could currently be replicating its “hump slump bump dump pump” pattern.

The hump slump bump dump pump pattern is a unique bullish continuation pattern that Brandt has continuously highlighted on Bitcoin’s chart. The pattern shows the asset’s price pushing up slightly, only to correct sharply, then push up slightly again, before dumping to around the low of the initial hump or lower and then surging to new highs.

Brandt appears to have first observed the pattern in Bitcoin’s 2017 bull run. To be sure, he came up with the quirky name for this pattern himself.

Per a Bitcoin daily candle chart shared on Sunday, December 29, the veteran commodities trader suggested that the target for the current pattern could be above the $110,000 price point. However, according to the analyst, something may need to happen first.

In a separate post, Brandt noted that Bitcoin needed to drop lower to fulfill the pattern. One possible scenario for this would be if the asset fulfilled a head-and-shoulders pattern he observed within the same chart. According to the analyst, the target for this pattern is $78,000.

At the time of writing, Bitcoin is trading just below the $94,000 price point.