Hyperliquid’s HYPE, following its billionaire airdrop, surged to a new all-time high on December 21 before entering a steep correction. Meanwhile, RENDER, the leading AI-focused token, has seen a sharp 20% decline over the past week, with its market cap falling to $3.7 billion.

Similarly, SOL has faced a significant 30% pullback in the last 30 days after its November peak of $264, yet its ecosystem remains active with thriving applications like Raydium and Pumpfun. Each of these tokens now approaches critical technical levels, setting the stage for potential reversals or continued corrections in the days ahead.

Hyperliquid (HYPE)

HYPE, the native token of Hyperliquid, has been the center of attention in recent weeks, following a highly publicized billionaire airdrop. The token reached a new all-time high on December 21 but has since entered a correction phase, following the pattern of other altcoins in the last week.

Over the last 24 hours, HYPE price has plummeted by 17%, reducing its market cap to nearly $9 billion.

From a technical perspective, the resistance level at $28.95 holds significant importance for HYPE’s price trajectory.

A breakout above this level could reignite bullish momentum, potentially pushing the token toward $35 and even $40 in the near term. Conversely, if the support at $22 fails to hold, the correction could deepen, dragging the price down to $14.99.

Render (RENDER)

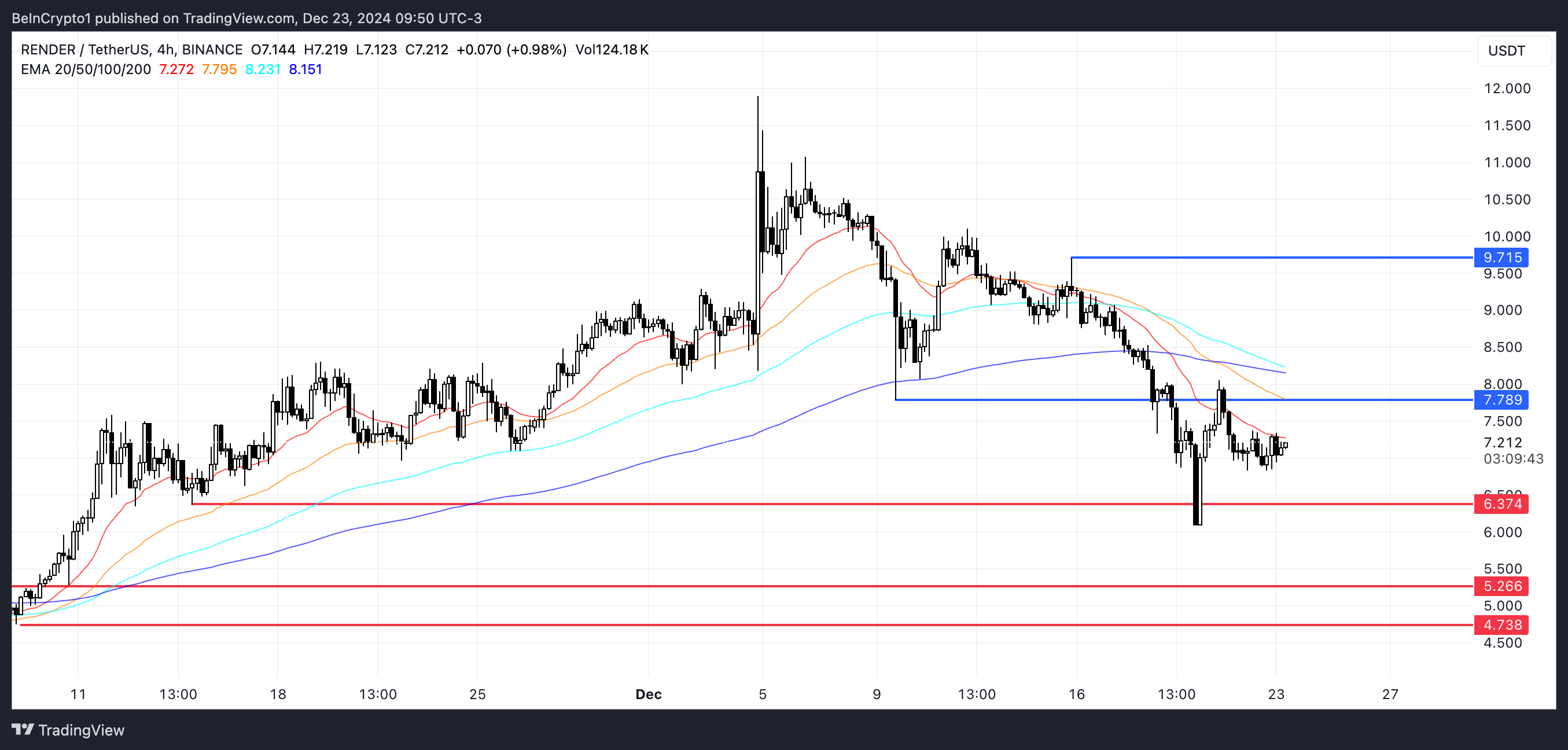

RENDER is the leading artificial intelligence token by market cap and is currently showing a sharp correction after peaking at almost $4.5 billion last week. With its market cap now at $3.7 billion, the token has declined nearly 20% over the past seven days.

This dip comes amidst growing anticipation that the AI narrative will continue to gain traction in 2025, potentially offering an attractive entry point for investors to enter AI altcoins. RENDER price action is currently in a strong downtrend, marked by the formation of a death cross on December 19, which shows the bearish momentum.

At present, RENDER is trading near a crucial support level of $6.37, with resistance around $7.78. A successful breakout above this resistance could pave the way for a rally toward $9.71.

However, failure to sustain the support at $6.37 could exacerbate the decline, with downside targets of $5.26 and $4.73 looming.

Solana (SOL)

SOL experienced a significant pullback after reaching an all-time high of $264 on November 22, with its price dropping nearly 30% over the past 30 days.

Despite this correction, the Solana ecosystem remains trending, with applications like Raydium and Pumpfun continuing to generate substantial traction, recording millions of dollars in daily fees and Solana altcoins such as PENGU, BONK, and WIF attracting a lot of attention.

Looking ahead, SOL’s price action hinges on key levels of support and resistance. The next critical support lies at $178; if this level fails, SOL could face further declines, potentially testing $158 and $147.

Conversely, the resistance at $195 is pivotal for a potential reversal. A breakout above this level could signal the start of a new uptrend, with targets at $203 and $221.