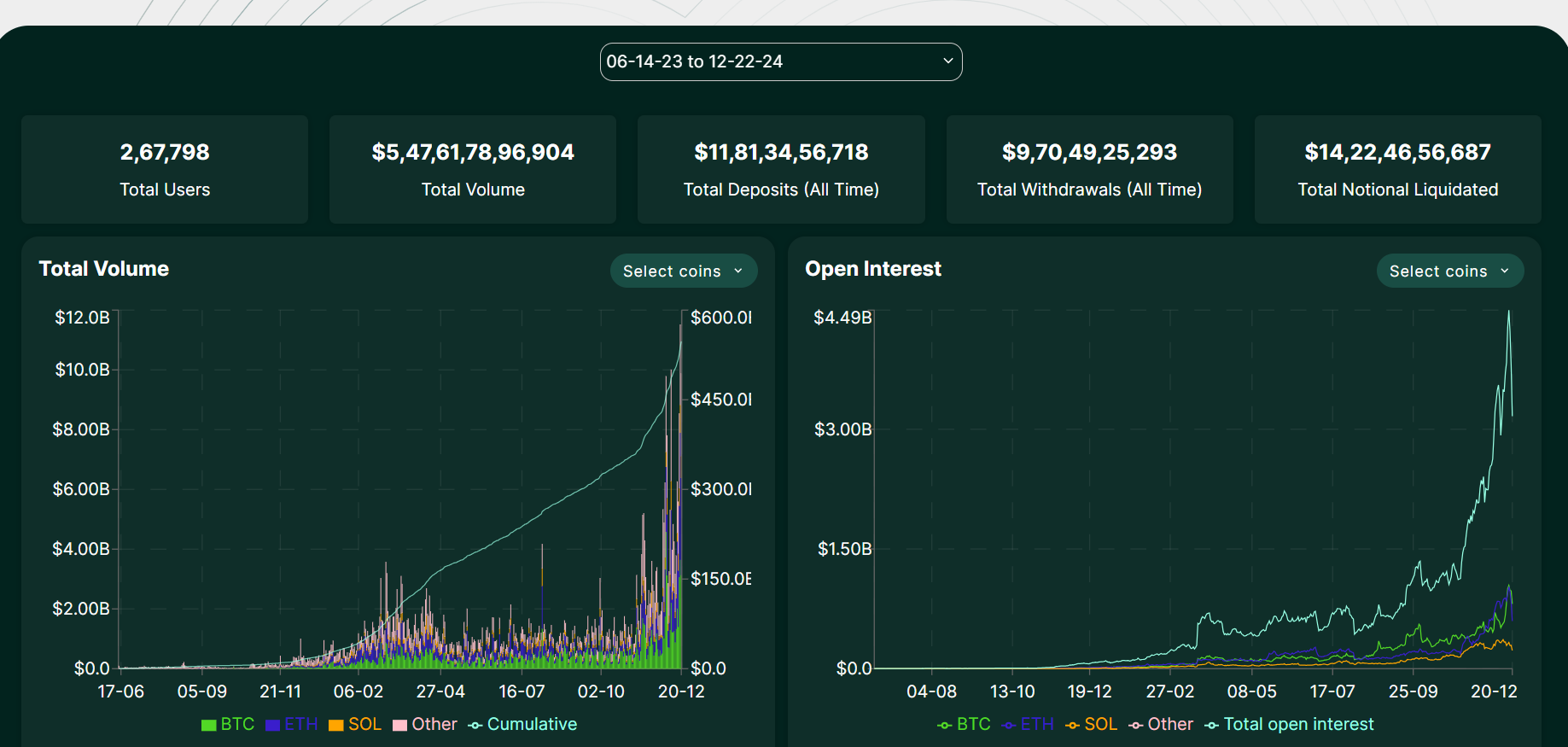

Hyperliquid has reached a milestone with $11.5 billion in trading volume and $1.32 billion in liquidation volume. This surge is by a massive airdrop of 310 million HYPE tokens, increasing liquidity and interest. Despite the success, risks such as price instability and liquidity challenges remain. The platform’s unique Dutch auction system adds both excitement and uncertainty.

Hyperliquid, has achieved a milestone by reaching a $11.5 billion trading volume and liquidation volume reaching $1.32 billion, as well as setting new all-time highs.

This surge is not only a reflection of Hyperliquid’s growth in the decentralized finance (DeFi) space. So, what is behind this explosive growth, and what are the challenges that come with it?

Reason behind the Hyperliquid surge

The huge increase in trading volume for Hyperliquid is mainly due to its massive airdrop. The platform gave away 310 million HYPE tokens to over 94,000 users.

HYPE, played a major role in this surge, quickly rebounding after a market dip and surpassing $33 to set a new historical peak with the assistance fund currently holding around 11.234 million HYPE tokens, which is worth approximately $356 million.

The platform’s assets are worth over $1 billion, and tokens like HYPE have even reached over $33, attracting a lot of attention.

As more people have started holding and trading the tokens, the platform has seen a huge rise in liquidity and trading volume. Within days, 270 million HYPE tokens were claimed, worth around 11.5 billion, which surrpassed Uniswap’s 2020 airdrop in size.

Some people think the price might drop later as the excitement fades, and Hyperliquid still relies on its own DEX trading to keep prices stable. Tokens like PURR and HFUN have seen huge gains, with some rising by 200%, which makes the platform even more attractive.

Hyperliquid stands out from other decentralized exchanges with its unique trading system and low fees. It has $2.62 billion in locked value and a fee model that supports buybacks and ecosystem growth.

The platform’s token supply is limited to 270.9 million out of a possible 1 billion, creating scarcity and demand. While Bitcoin and other altcoins saw price drops, HYPE’s price increased.

Hyperliquid uses a Dutch auction system, where token prices drop until a buyer is found, thus driving up the token’s value quickly by limiting the number of tokens and using this auction model.

Hyperliquid avoids flooding the market with too many low-value tokens, keeping them more exclusive. Auctions for tokens like GOD and HFUN have shown how quickly they can generate high demand.

Hyperliquid’s high liquidity, especially for HYPE and other tokens, has been key to its record trading volume. As more tokens are added to the platform, liquidity keeps improving, which is attracting more traders.

The liquidity to the market cap ratio of HYPE is 4.8%, which increases trading activity as more assets could join the platform.

The other side

Even though Hyperliquid has been successful, its approach comes with risks. The limited number of tokens and auctions help prevent oversaturation but can also make prices unstable.

New tokens often lack liquidity or market makers, which can cause their prices to freeze. However, as more liquidity comes in, some tokens might suddenly spike in price.

The airdrop-driven surge in users could lead to price instability. Once the initial excitement dies down, many users may sell their tokens, causing price drops and volatility. The Dutch auction system also creates unpredictable price discovery. It can lead to overvaluation of tokens, which may experience sharp declines once market sentiment shifts.

As more tokens enter the ecosystem, many may lack the liquidity or stability to maintain long-term value, especially as the regulatory landscape for DeFi platforms becomes more uncertain.

The increasing cost to secure a ticker, which can reach nearly $1 million, makes it hard for smaller projects to join. This also helps keep out low-value tokens.

While this system helps feature valuable tokens, it can also leave some tokens without enough trading activity for a long time, making it risky to trade on the platform. The long-term effects of this approach remain uncertain for now.