XRP came under significant selling pressure that threatened a dip below the $2 level, but analyst Steph has cited a potential rebound that could propel its price nearly fivefold.

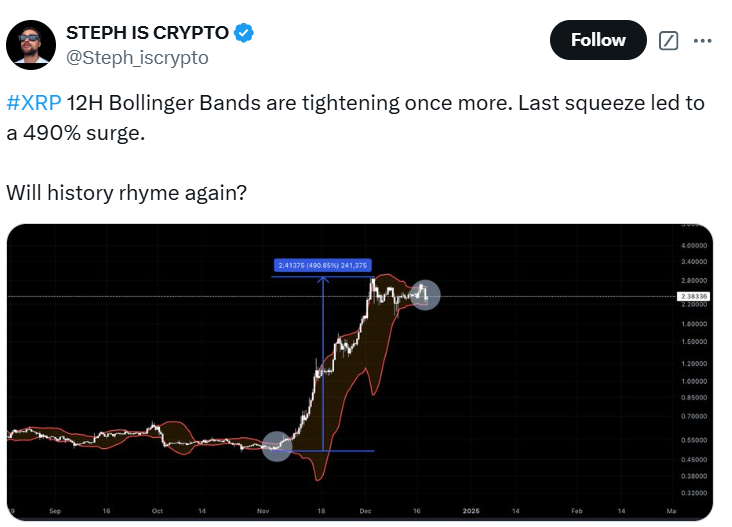

In a tweet on X, Steph highlighted that the Bollinger Bands for XRP on the 12-hour chart have started to tighten again. Historically, this technical setup has preceded significant price movements. The most recent example is the explosive 490% rally observed a few weeks ago.

The Technical Setup

The popular Bollinger Bands indicator measures market volatility and provides key support and resistance levels. A “squeeze” occurs when the bands contract, signaling reduced volatility and often foreshadowing a major price movement.

For XRP, the last time this indicator tightened on the 12-hour timeframe triggered a parabolic surge, elevating the token’s price from around $0.49 in the first week of November to $2.90 by the first week of December.

Will History Repeat?

Now, analyst Steph has noticed another Bollinger Bands squeeze on the 12-hour chart, speculating that another breakout may be imminent.

Currently, XRP’s price is hovering around $2.26, consolidating after its recent bullish rally. Yesterday, XRP revisited lows around $2.17, coming close to breaking below the $2 psychological mark.

Nevertheless, the observed tightening of the bands amid this price action suggests that market participants are anticipating the next major move.

If the breakout follows a similar 490% rally as seen a few weeks ago, market participants could see XRP’s price rise as high as $13.33.

However, while the prospect of history repeating itself is enticing, analysts like Steph are adopting a more conservative price outlook for XRP in the short term rather than targeting a lofty $13. Some believe that $13 could represent the peak for XRP in this cycle.

In the near term, market analysts are predicting a price rally to between $4 and $5 before another correction phase.

Key Levels to Watch

Amid the ongoing correction, analysts emphasize the importance of XRP maintaining support around the $2 level for a continued bull run.

Casi Trade suggests two potential scenarios: a correction with support near the trendline or further bearish movement below it. She noted that holding the $1.90–$2.00 range is crucial for XRP’s recovery.

Market commentators like Chad Steingraber and IncomeSharks also highlight the potential for a rebound, with Steingraber seeing a “double tap” at $2 as a potential launch point for new highs. So far, in the latest market downturn, XRP has held above $2.

On the other hand, some traders are watching critical resistance at $2.90, which could pave the way for further gains if breached.