The U.S. government successfully shut down the Liberty Dollar, a private currency created by Bernard von NotHaus, while Bitcoin, established by the mysterious Satoshi Nakamoto, continues to thrive outside governmental control. This discrepancy highlights the stark differences between the centralized creation of the Liberty Dollar and the decentralized nature of Bitcoin.

Contrasting Currencies — The Shutdown of Liberty Dollar and the Survival of Bitcoin

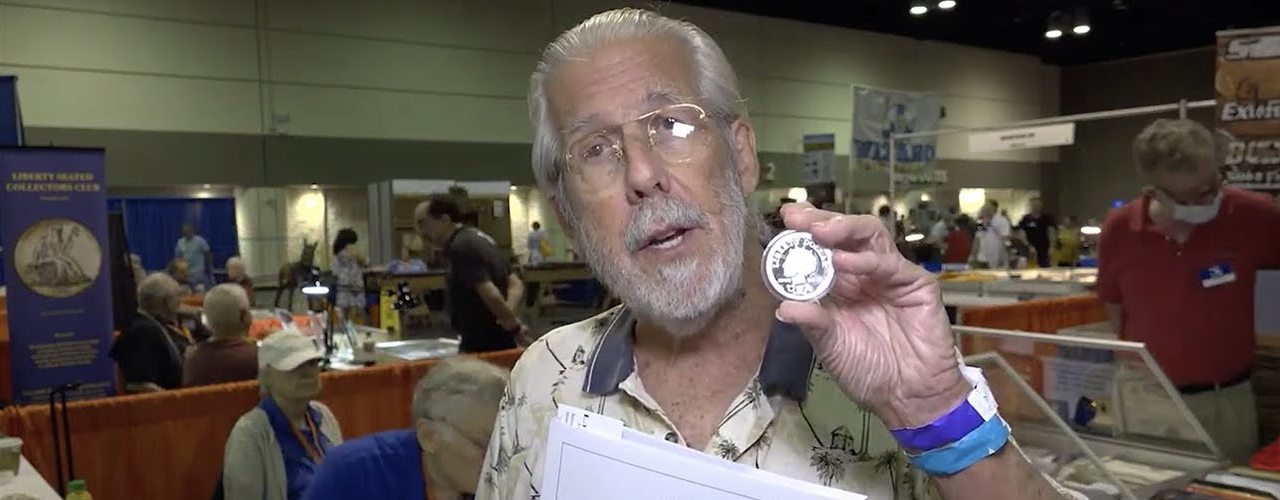

Bernard von NotHaus introduced the Liberty Dollar in 1998 as a physical and digital private currency backed by precious metals, aimed at providing an alternative to the U.S. dollar. Operating from Evansville, Indiana, the Liberty Dollar was distributed through a network that promised stability and value preservation, unlike the fiat currency system. However, the U.S. government halted operations in 2007, and von NotHaus was later convicted for creating, possessing, and selling his own currency, which was seen as a form of counterfeiting and conspiracy against the U.S.

The government’s ability to shut down the Liberty Dollar was primarily because it was centralized, with identifiable leadership and physical assets within U.S. jurisdiction. Von NotHaus’s direct involvement and the currency’s tangible nature made it vulnerable to legal action, highlighting the risks of centralized entities that challenge the U.S. dollar.

In contrast, Bitcoin, introduced in 2008, operates on a decentralized blockchain technology created by an entity (or group) known as Satoshi Nakamoto. Unlike the Liberty Dollar, bitcoin (BTC) is not backed by physical assets but by the cryptographic integrity of its network. Bitcoin’s decentralized model means that no single party controls the network, making it nearly impossible for any government to shut it down. The network operates on a global scale, with nodes spread across numerous countries, further complicating any single government’s attempt to exert control.

Initially, Bitcoin’s reach was limited to a small group of cryptography enthusiasts and tech-savvy individuals who communicated primarily through online forums and specialized mailing lists. This niche community shared information and developments about Bitcoin mostly via word of mouth, spreading knowledge within a tight-knit but globally dispersed group. This method of communication helped maintain Bitcoin’s low profile in its early stages, allowing it to develop under the radar of mainstream financial services and government scrutiny.

Furthermore, the identity of Satoshi Nakamoto remains unknown, adding an additional layer of protection against regulatory actions that were effective against centralized entities like the Liberty Dollar. The decentralized nature of Bitcoin ensures that it operates beyond the reach of straightforward legal challenges that face traditional financial systems and their operators.

The case of the Liberty Dollar versus Bitcoin illustrates the challenges governments face when dealing with decentralized technologies. While traditional legal frameworks can tackle centralized entities, decentralized systems like Bitcoin require new approaches and understandings, reflecting the evolving nature of currency in a digital age.

What do you think are the key factors that allowed Bitcoin to thrive despite regulatory challenges, and how do you see the future of decentralized currencies evolving? Share your thoughts below.