The crypto market has not been the same for every asset. Bitcoin (BTC) has had a good run, but top coins like Ethereum (ETH) and Ripple (XRP) are still suffering. The chances of altcoins picking up pace and rallying rely on Bitcoin’s performance.

Identifying the altcoin season is important as it can estimate when and how much growth alts could experience.

The Potential of an Altcoin Season

Juan Pellicer, Senior Researcher at IntoTheBlock, states multiple signals dictate the altcoin season’s arrival.

“In previous market cycles, altcoin seasons often begin with a sustained downtrend in BTC dominance, indicating a shift in market sentiment towards altcoins. While this trend is a useful leading signal, identifying potential winners in the next altcoin season requires analyzing advanced on-chain metrics,” Pellicer stated.

“For instance, the average holding time of an asset by its holders can indicate its resiliency. Assets held longer by investors may experience more sustained price rallies during bull markets. Additionally, on-chain data related to whale behavior is invaluable,” he added further.

Secondly, the market’s growth also relies on the overall demand for crypto assets. The recent rise is a sign confirming this demand. However, stability is the next concern. Expanding on the same, Julio Moreno, Head of Research at Cryptoquant, told BeInCrypto,

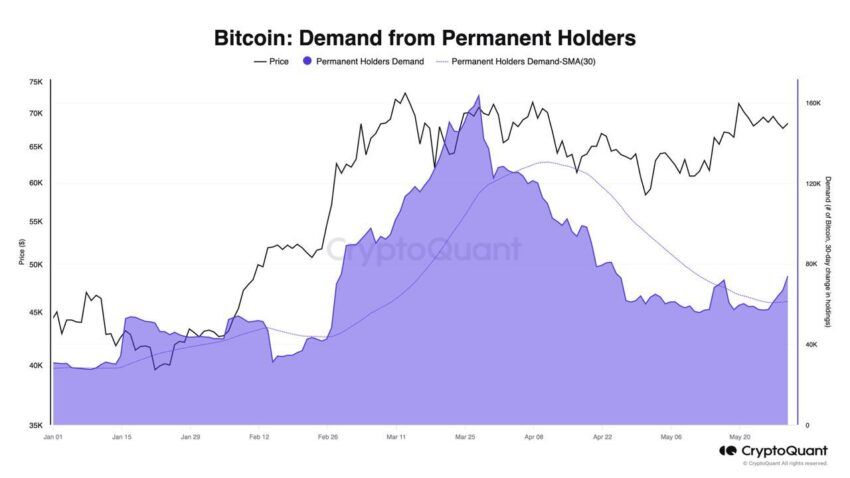

“The stabilization and then slight increase in Bitcoin demand from Permanent holders and large holders (whales). This indicates higher demand growth this month compared to April. Permanent holders have bought 74K Bitcoin in the last 30-days, while demand from whales is growing at 5% MoM now. See second and third chart. We still need to see higher demand growth from these investor cohorts for the price rally to be sustainable.”

Thus, these cues are key when looking for a guide to the altcoin season.

Price Prediction for BTC, ETH, XRP: Growth Likely, Though Slow

Bitcoin (BTC)

Bitcoin’s price exceeded the market’s expectations as it charted a 5% growth over the week. This rise brought the trading price to $71,160, close to the critical resistance of $71,800. The broader market cues are still bullish, with BTC moving within a flag pattern, indicating a 45% rally on the cards.

However, the more practical outlook is a rise to the current all-time high of $73,650. Breaching it would establish a new ATH for BTC.

Read More: Bitcoin Halving History: Everything You Need To Know

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingViewBut losing it could send the altcoin to $0.50 or lower to test the critical support of $0.47, invalidating the bullish thesis completely.