Shiba Inu has multiple sell walls on the path to $0.00006, but the last resistance posing a roadblock features a hurdle of 29 trillion tokens that SHIB needs to breach.

The market has pivoted to a recovery phase, but some altcoins have still not reclaimed their yearly highs despite Bitcoin (BTC) spiking above the $71,000 threshold. Shiba Inu is not left out on this recovery campaign, but continues to face immense resistance due to multiple sell walls on its path.

On June 5, SHIB rallied to a high of $0.00002633, breaking the pivotal $0.000025 level as it towered over the 50-day exponential moving average (EMA). This development ushered in bullish momentum in the mid-term, with Shiba Inu riding on the Bitcoin resurgence and the broader market uptrend.

Shiba Inu’s Immediate Supply Wall

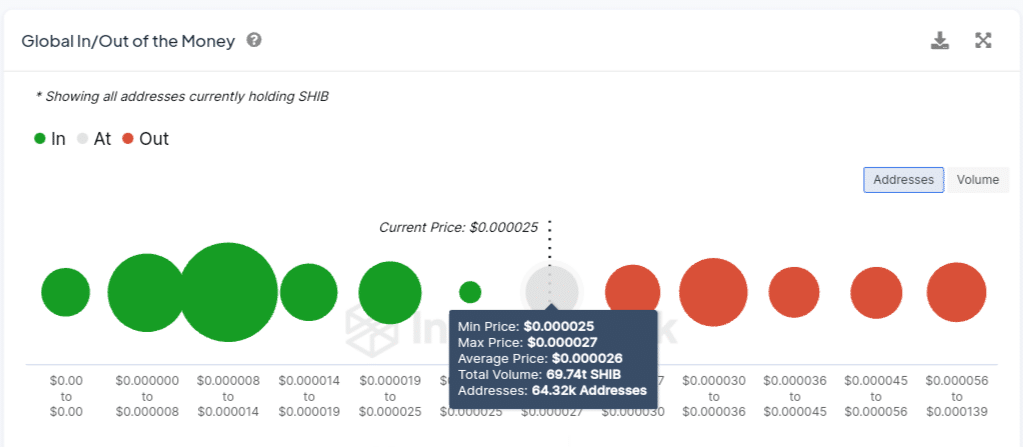

However, this $0.000026 threshold represents one of the massive sell walls standing between Shiba Inu and greater heights, per IntoTheBlock data.

Particularly, at this wall, 64,320 addresses procured 69.74 trillion SHIB tokens at an average price of $0.000026. Whenever Shiba Inu retests $0.000026, these addresses push to sell off their holdings, bolstering selling pressure.

The ensuing selling pressure then leads to a correction, as was observed in the latest movement. Notably, SHIB has now retraced most of the gains it picked up during the recent rally, having slipped below the $0.000026 price level. Shiba Inu is now looking to hold above $0.000025 and leverage it for a second push up when the bulls return.

Shiba Inu would need to confidently close above $0.000027 to surpass this immediate sell wall. However, after this, it has to face five more supply walls on the journey to $0.00006. The largest of them in terms of wallets features 140,260 addresses holding 19 trillion SHIB between $0.00003 and $0.000036.

Shiba Inu Faces 29T Resistance at $0.00006

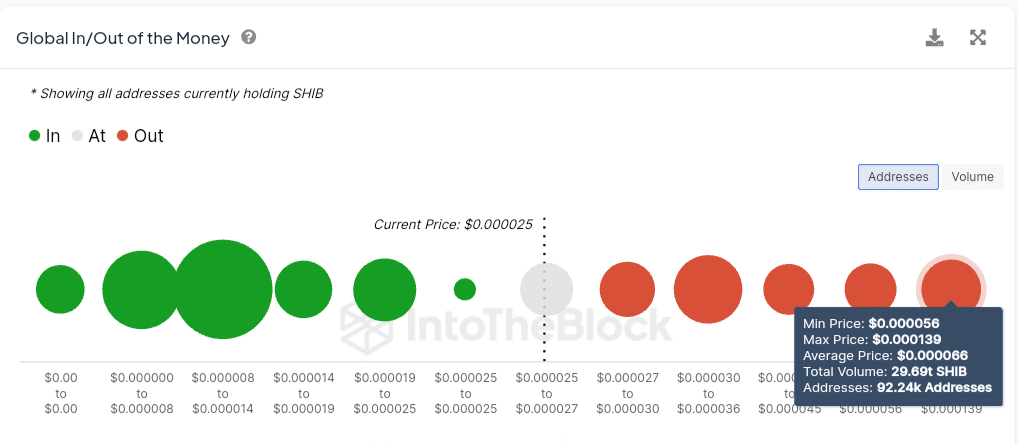

Beyond this point, SHIB is likely to face minimal resistance at the next two supply walls due to lower volume and lower concentration of addresses. Notably, they each hold 8.45 trillion and 3.3 trillion Shiba Inu tokens, presenting a rather negligible resistance to break.

However, the last sell wall boasts a more substantial resistance. This roadblock is stationed at a point where 92,240 addresses bought 29.69 trillion SHIB, 5% of the circulating supply, at an average price of $0.000066. Breaking this level would allow Shiba Inu clinch a new yearly high above the $0.00006 zone.

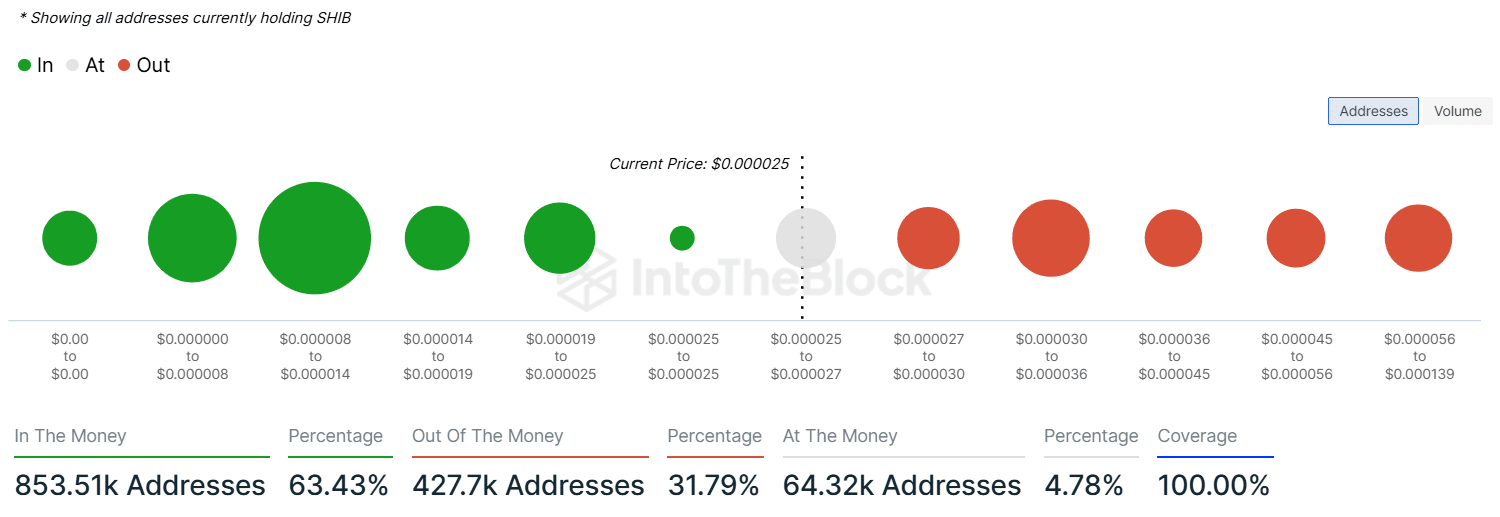

Notably, it bears mentioning that these sell walls represent points at which multiple clusters of addresses hold SHIB at a loss. Combined, IntoTheBlock data suggests that 427,700 addresses are holding Shiba Inu at losses. Meanwhile, 853,520 addresses are currently in the money, positioned to act as support against price drops.

The large amount of Shiba Inu addresses in profit, representing 63.43% of total holders, is due to Shiba Inu’s decisive spike beyond $0.00001 this year. Despite the turbulence, SHIB has held up well above $0.00002, with constant struggles to reclaim $0.00003. SHIB currently trades for $0.00002534, down 2.16% in the last 24 hours.