- Ethereum ETFs ‘will take some time’ before they launch, according to SEC Chair.

- ETH's open interest on exchanges surged 50% to a new all-time high after SEC’s U-turn towards ETH ETFs.

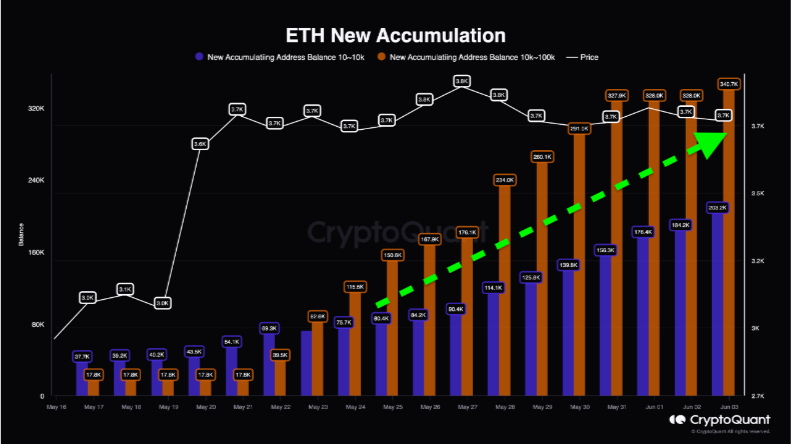

- New accumulating addresses holding 10-10K and 10K-100K ETH have grown steadily after ETH ETF 19b-4 approvals.

Ethereum (ETH) price hovered around $3,860 on Wednesday following Securities & Exchange Commission (SEC) Chair Gary Gensler expressing his opinion that the launch of spot ETH ETFs may be delayed. Meanwhile, Ethereum derivatives products on exchanges have seen a surge in open interest (OI).

Daily digest market movers: ETH ETFs delay, rising open interest, new accumulating addresses growth

In an interview with CNBC on Wednesday, SEC Chair Gary Gensler said spot ETH ETFs would "take some time" before they go live on exchanges, indicating S-1 approvals are not imminent. He noted that his agency is still working on disclosure measures with exchanges.

After the SEC's sudden approval of 19b-4 filings from eight issuers on May 23, several analysts expected the agency to respond to S-1 registration statements quickly. The SEC's request for issuers to submit updated S-1 filings on Friday also seemed to have confirmed the expectations of these analysts.

Following the filings, Bloomberg analyst Eric Balchunas suggested spot ETH ETFs would launch in July. However, with Gensler's recent comments, it may take longer before the ETFs begin trading.

In other news, open interest (OI) for ETH derivatives products on exchanges reached a new all-time high, rising by 50.3% to $14 billion, according to CCData Exchange Review for May. Notably, open interest on the Chicago Mercantile Exchange (CME) surged by 59.4% to $1.25 billion.

Meanwhile, the balance of new accumulating addresses holding between 10 - 10K and 10K to 100K ETH has been growing steadily since the SEC's pivot on ETH ETF, according to data from CryptoQuant.

ETH New Accumulation

ETH technical analysis: Ethereum to maintain sideways trend until spot ETH ETFs launch

Ethereum saw a slight gain on Wednesday, trading near $3,860 and continuing its sideways trend.

ETH's 30-day MVRV also aligns with the horizontal move, hovering around 6% in the past week. This indicates that the number of Ethereum addresses that purchased the coin within the last 30 days has seen an average of 6% gains.

Despite the horizontal trend, whales are still accumulating ETH, and both long-term and short-term holders will likely hold onto their tokens.

ETH may continue its horizontal trend until the official launch of spot ETH ETFs. The $3,618 price level remains key support in case of short-term price swings. In the long term, ETH may overtake the $4,093 resistance and flip the $4,878 level to set a new all-time high of around $5,000.

ETH/USDT 4-hour chart

QCP Capital analysts also share the bullish view: "ETH has been lagging on this move, but we expect a catch-up and possibly even outperformance against BTC when the ETH spot ETF begins trading," they said.

ETH liquidation data shows a total of $23.78 million liquidations, with $13.81 million of liquidated long positions and $9.97 million of shorts, according to data from Coinglass.